The Market Brief

U.S. stock index futures rose on Wednesday as investors awaited key bank earnings, following strong reports from lenders that helped lift markets in the prior session.

Macro Viewpoint

Policy volatility continues to be a feature rather than a bug.

Following Friday’s market turmoil, when fresh tariffs on China triggered the S&P’s ninth most extreme risk-adjusted one-day selloff in half a century (a six-standard-deviation move), yesterday the stock market erased ~$430 billion in five minutes after President Trump threatened to “start producing cooking oil” in the US. Let that sink in.

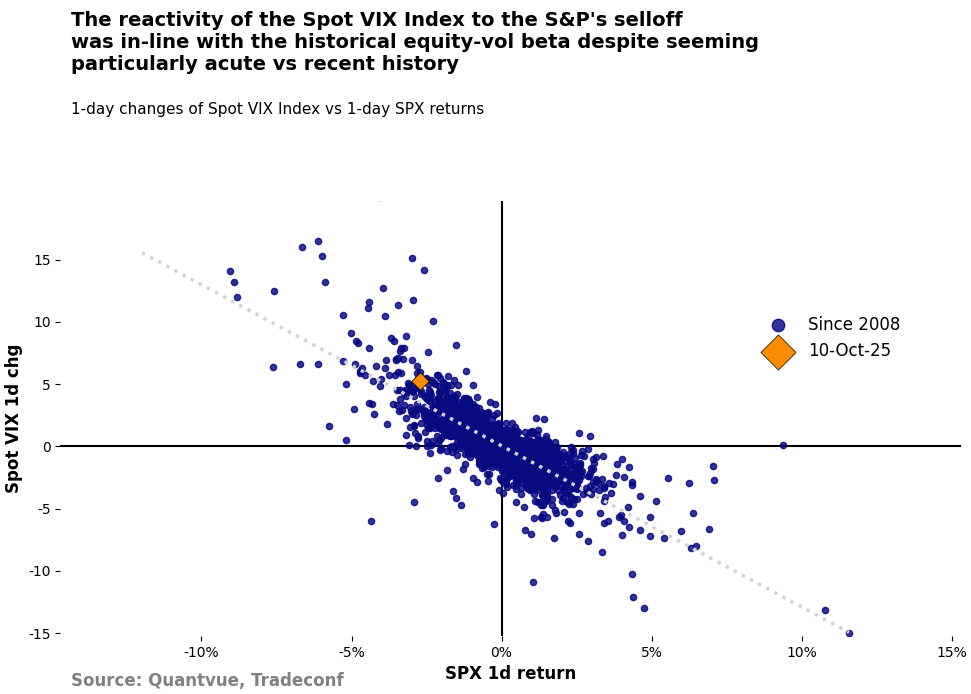

However, while Friday’s move appeared sharp in the context of the recent equity market calm, the beta between the S&P and the 1-month VIX was in line with historical norms, although the media might have made you believe it was the end of the world.

Markets have evolved into their most reactive form in history, and this is the new normal. Considering that volatility is expected to remain high, you should adjust to this new normal. The market is not going to adjust to you.

We remain data-dependent and update our market outlook in today’s brief, which you can access now by being a subscriber. 👇