The Market Brief

Hey team. Futures surged during early trading on Monday as talks over the weekend between US and China have resulted in positive rhetoric.

Let’s see what’s ahead for the markets!

Macro Viewpoint

U.S. stock index futures surged on Monday following news that the United States and China had reached an agreement to ease tariffs, offering relief to markets that had been rattled by escalating trade tensions.

Both countries confirmed plans to scale back tariffs, marking a step toward diffusing a prolonged trade conflict that has disrupted global economic stability.

As outlined in a joint statement, the U.S. and China will temporarily reduce tariffs on each other's goods—a move aimed at lowering trade friction and allowing a 90-day window to negotiate a more lasting resolution.

The combined 145% US levies on most Chinese imports will be reduced to 30% including the rate tied to fentanyl by May 14, while the 125% Chinese duties on US goods will drop to 10%, according to the statement and officials in a briefing Monday in Geneva.

Wall St. Prime Intel

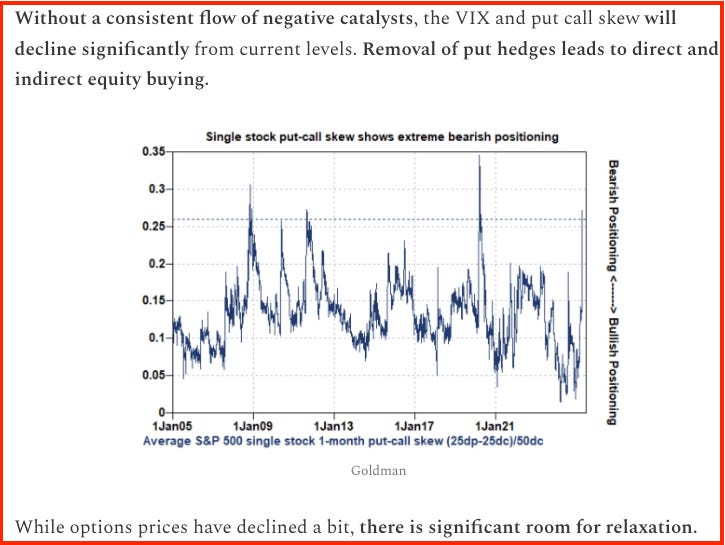

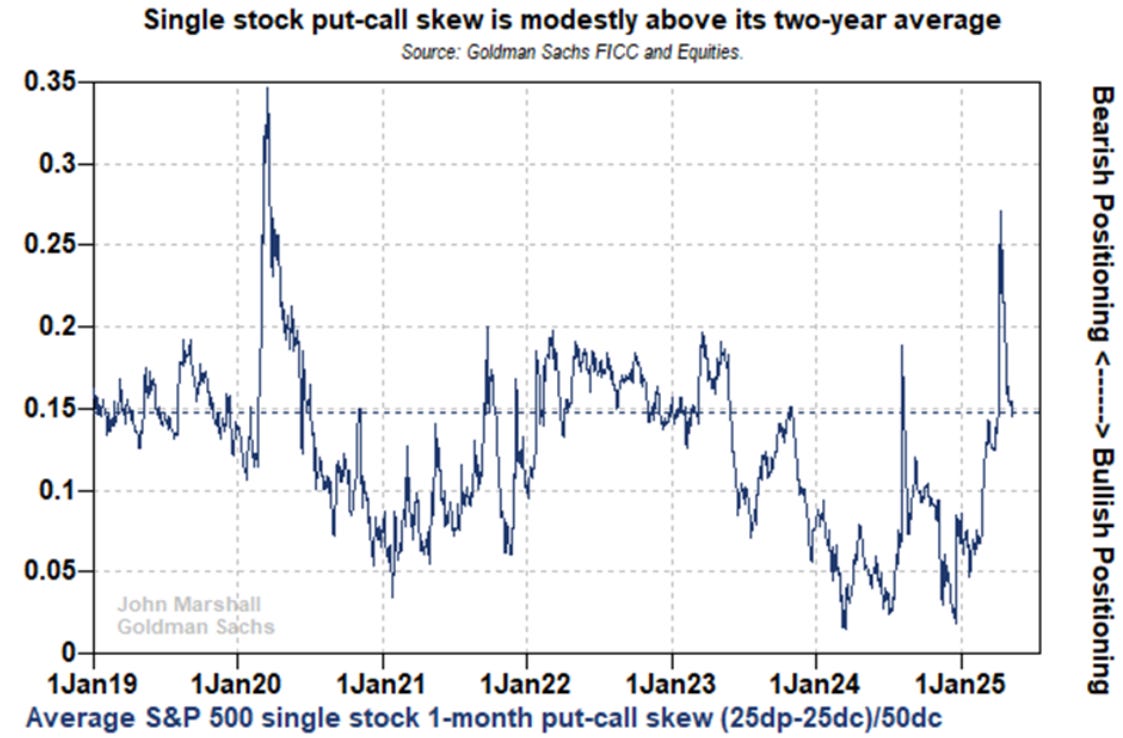

Single stock put-call skew has been a great crowd-sourced metric to describe fear levels over the past 20 years. This was the most important metric behind our “near-term-bullish” call we’ve made on April 14th [HERE] as it hit levels consistent with extreme fear in 2008 and 2020.

While fear has moderated, it remains well above two-year average levels and above levels from the weeks before the April 2nd Tariff announcements. We believe this shows the rally is not crowded and there is more room for fear levels to decline.

This remains the most useful quantitative options signal for predicting SPX forward returns.

If you want access to these exact quantitative modules that we share weeks and days before the fact and come straight from investment banks, consider becoming a paid subscriber.👇