The Market Brief

U.S. futures lower during early trading as concerns over a U.S. government shutdown clouded the release of data seen as crucial for determining the path of Federal Reserve interest-rates.

Impact Snapshot

🟥 JOLTS Job Openings - 10:00am

🟥 Consumer Confidence - 10:00am

🟥 President Trump Speaks - 11:00am

Macro Viewpoint

Given the importance of the job market to the Fed’s rate-cutting decisions, the risk that the September unemployment report could be delayed due to a government shutdown adds to the market’s anxiety over the direction of policy.

If the shutdown happens, we likely will not get September’s employment report as scheduled at 8:30 a.m. on 10/3, and prediction markets put roughly an 80% probability on this occurring.

However, over the past several years, there have been multiple near-misses in which the odds of a shutdown appeared very high just before the deadline, but a last-minute deal was reached.

Prime Intelligence

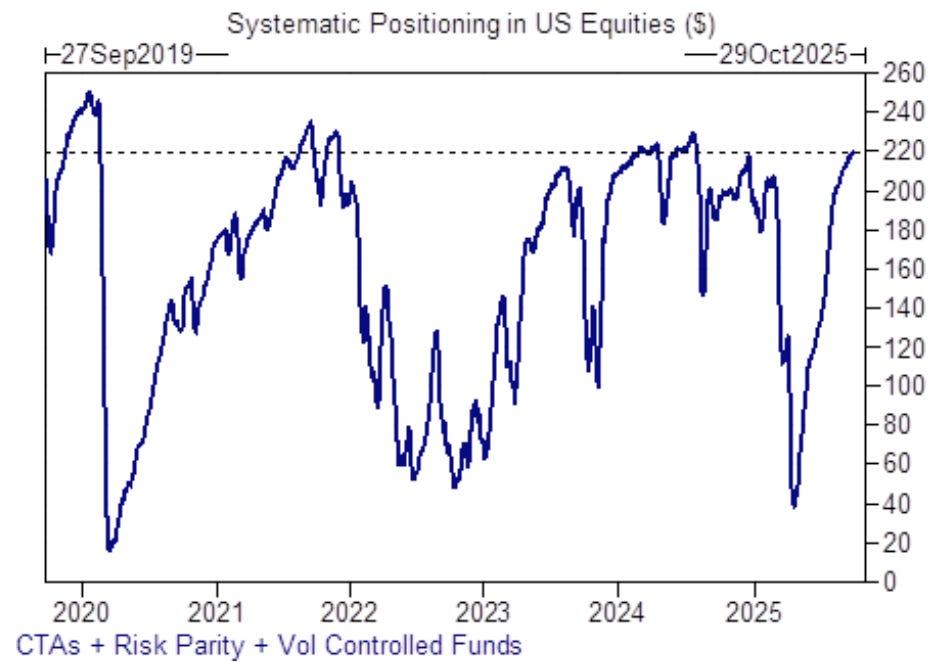

CTAs’ overall equity long positioning rose last week, driven by a broad-based increase in positioning across regions. These longs have steadily increased over the last month on continued declines in realized volatility and have now become stretched on the S&P 500 and NASDAQ.

Back in May, we shared exclusively with our subscribers that we hit systematic triggers that unleashed BILLIONS in buying and triggered one of the best recoveries of all time.

We now see this cohort as asymmetric sellers in down tape scenarios, and in today’s Prime Intelligence, we’re sharing the exact pivots that will determine allocation by these strategies.