The Market Brief

U.S. futures edged higher, lifted by expectations of an upcoming interest rate cut, in the final trading session of a volatile week marked by a government shutdown that has dragged into its third day.

Impact Snapshot

🟥 ISM Services PMI - 10:00am

Macro Viewpoint

The recent rally underscores how bullish momentum is overshadowing concerns about a US government shutdown, now in its third day and prompting a blackout in key economic data.

Historically, shutdowns have been short and don’t cause much of an economic impact. But they can lead to delays in economic data releases.

The DoL (which oversees the BLS) has already confirmed that it will not be releasing or collecting data during the shutdown. They estimate that for the BLS, shutdown related backing up of systems may take up to three days.

There will be no jobs report today. Two weeks after the Fed cut rates due to a weak labor market, jobs data has been indefinitely suspended.

The release will likely be delayed for a few days even after the shutdown ends. We’re 26 days from the next Fed meeting, with today’s suspended jobs report being the final one before their next meeting.

Q3 Earnings

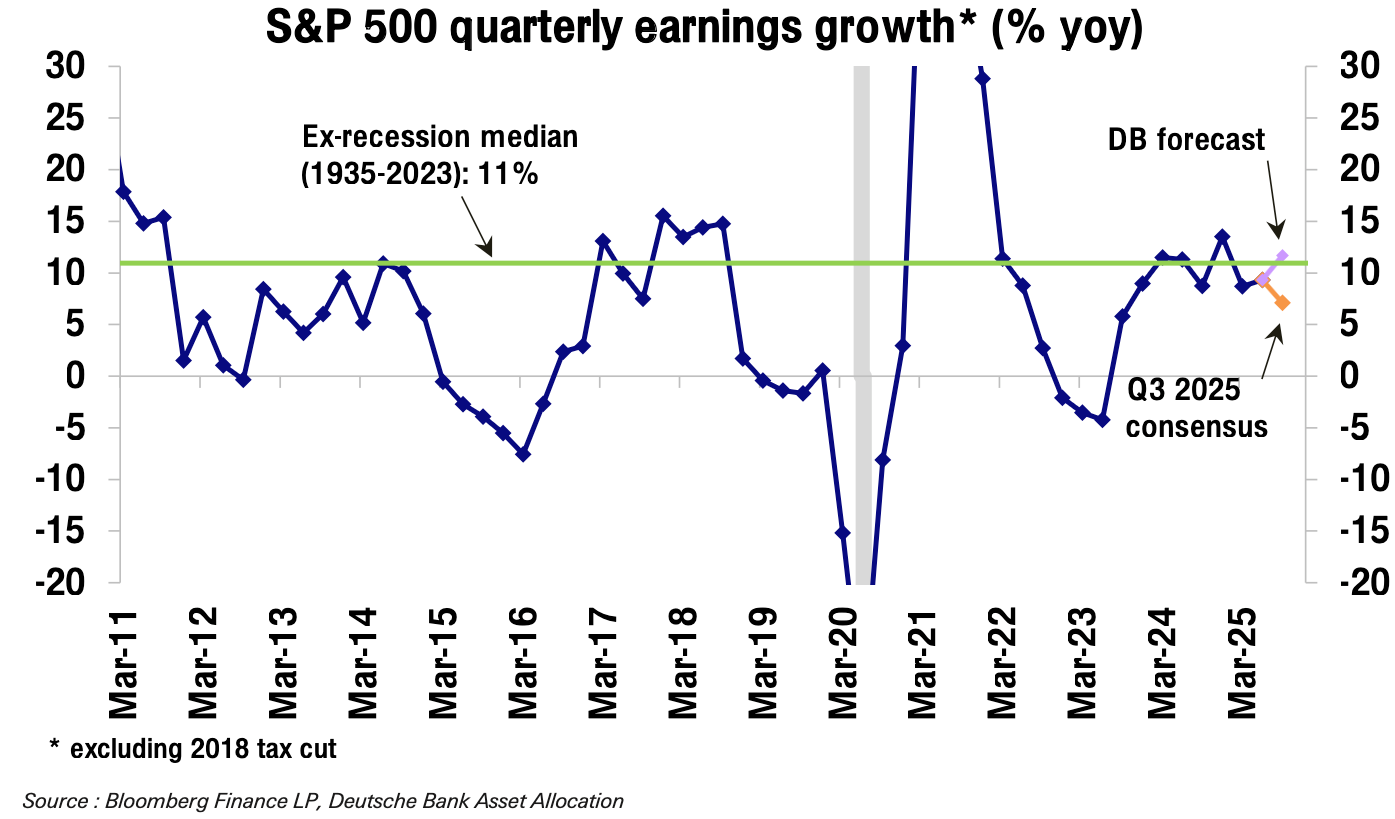

Markets are now eyeing the upcoming earnings. S&P 500 earnings growth has been hovering in a robust range around 11% for nearly 2 years. The macro backdrop has become favorable, with recent data pointing to solid growth in Q3.

On the back of strong macro growth and a lower dollar, we see earnings growth picking up from 9.3% in Q2 to 10.7% in Q3, while the consensus sees growth declining to 7.2%.

This is a FREE edition of the Market Brief. To receive our additional institutional-grade research, consider becoming a paid subscriber.