The Market Brief

Hey team. The AI demand boom forecast powered gains across the entire market overnight after a breather in the prior session.

Let’s re-cap yesterday’s session and see what’s next!

Macro Viewpoint

U.S. equity futures signaled a robust finish to the week, driven by a premarket rally in Broadcom Inc. that lifted the entire chip technology sector.

After recent gains and strong economic data, Wall Street paused in the previous session ahead of the Federal Reserve's upcoming meeting.

On Thursday, the Labor Department reported that U.S. producer prices rose more than expected in November. However, a slowdown in service costs reinforced the broader trend of disinflation.

Meanwhile, initial claims for U.S. unemployment benefits unexpectedly increased last week, raising concerns about the resilience of the labor market.

According to the CME FedWatch Tool, trader expectations for a rate cut at the Fed's Dec. 17-18 meeting exceed 96%. Still, the tool suggests a likelihood of a pause in rate adjustments come January.

Prior Session Deep Dive

Every day, when we create this market brief and plot our references on the chart, we have to make a choice about which levels to include on the chart that are most likely to offer the best reaction out of many.

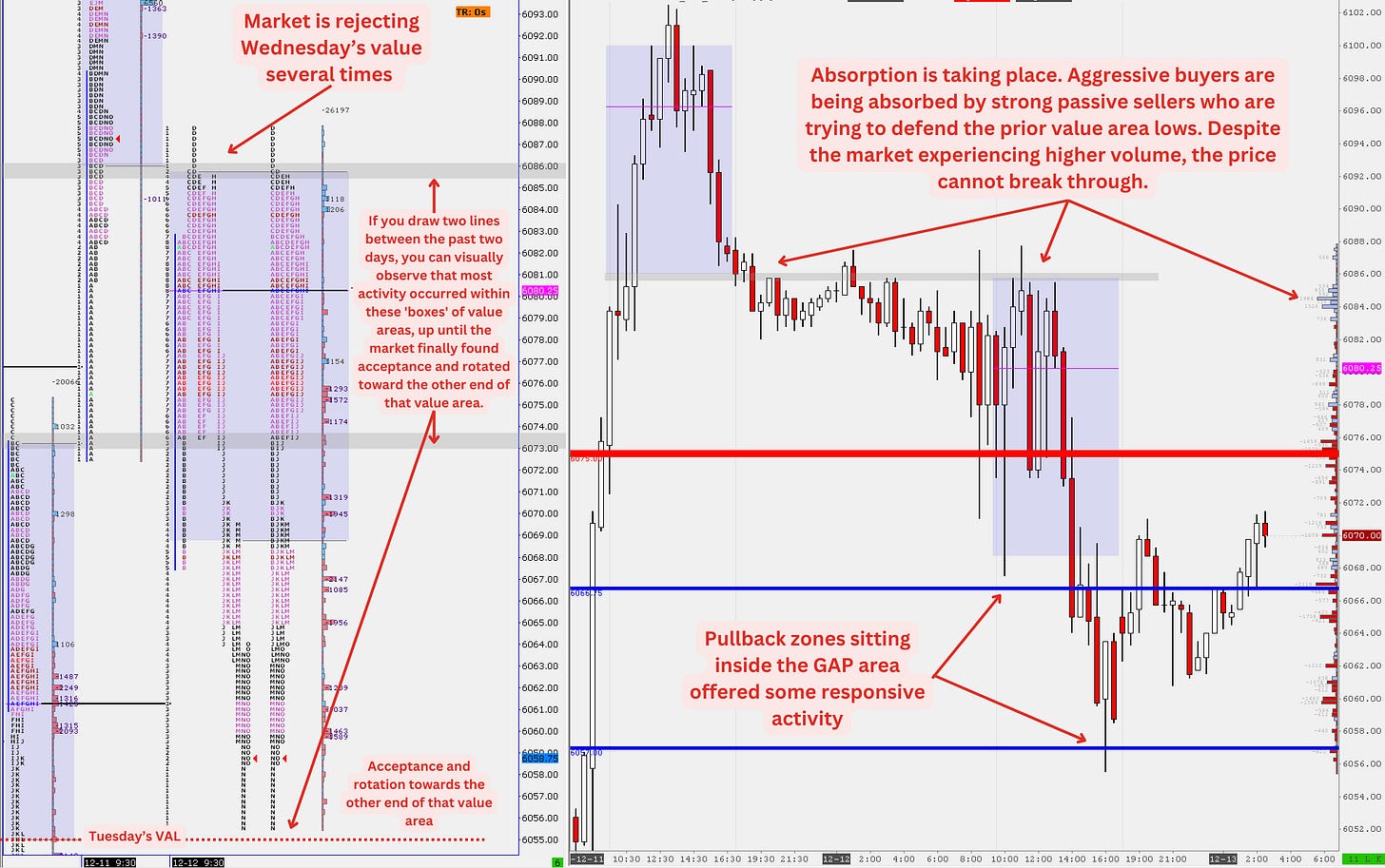

One thing that never changes and is always present is the blue-tinted boxes, and that's for a good reason. Price by itself will only tell you half the story of what is happening in the market. Understanding where value is shifting will drastically improve your market understanding.

Anything that you apply to higher timeframes, such as balance zones, multi-day ranges, and value areas, is applicable to the daily timeframe as well. Did we accept or reject the prior value? If we accepted it inside a prior value area, where is the destination target?

On the chart above, both on the candlesticks and market profile, you can visualize the value area boxes and how they played a key role during yesterday’s U.S. session.

The market made several attempts to enter the prior value area above, which were rejected. This left a significant number of longs trapped at those highs, as visualized by the positive deltas.

Despite the market's increased volume at these highs, the buying aggression was absorbed right at the value area lows of the prior session. This continued attempt to break out ultimately failed, as the market failed to sustain the tone-setting reference, which led to a liquidation break that saw continuation inside the gap.

As always, gaps are voids of price, and if you find acceptance inside them, you get these quick moves toward the other side.