The Market Brief

US stock futures rose at the start of the final full trading week of 2025 as traders positioned for delayed November jobs data and key inflation readings later this week.

Macro Viewpoint

US equity-index futures climbed as the final full trading week of 2025 got underway, following a selloff driven by concerns over tech earnings and heavy AI-related spending.

Investors are turning to this week’s delayed jobs and inflation reports to fill the gap left by the US government shutdown, looking for clues on the state of the economy and the path of interest rates.

These data points will be key in shaping expectations for 2026, helping answer whether the Fed is close to finishing its three-rate cuts or if it may need to act more decisively.

Prime Intelligence

It’s contract rollover week, following the final full trading week of 2025.

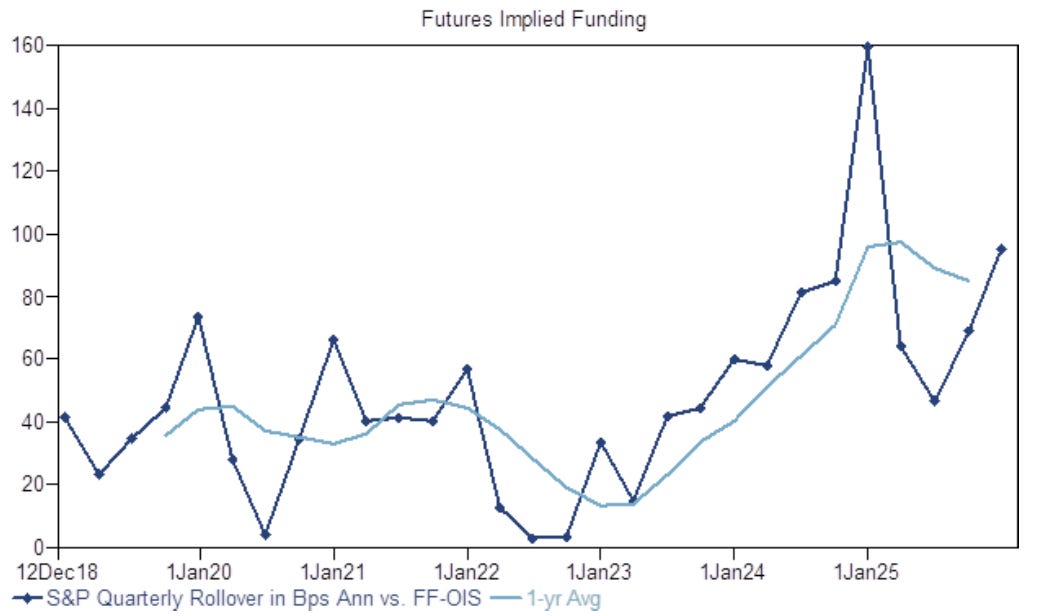

The implied financing rate in S&P futures is currently around F+100 bps, and moved even higher on Friday as traders roll positions from the December to March contract. This is the second-highest level on record, only behind last year’s year-end roll, which averaged a much steeper F+160 bps.

Elevated implied funding benefits shorts and penalizes longs. This dynamic is typical in Q4, when year-end balance sheet pressures tend to push funding rates higher than in other quarters.

📰 In today’s brief, we break down the latest institutional positioning across both discretionary and systematic strategies.

Is there still room for the market to move higher? What does market breadth reveal about recent price action? Are investors leaning toward risk-on or risk-off?