The Market Brief

U.S. stock futures edged lower on Friday, signaling a fresh round of sell-off after hawkish comments from FED officials added to doubts about an interest rate cut in December.

Macro Viewpoint

Market weakness carried over from Thursday until now on continued rotational dynamics out of AI/tech and into defensive sectors. This was a “buy gov’t rumor of shutdown ending last Fri, sell the news on the actual end” type of activity.

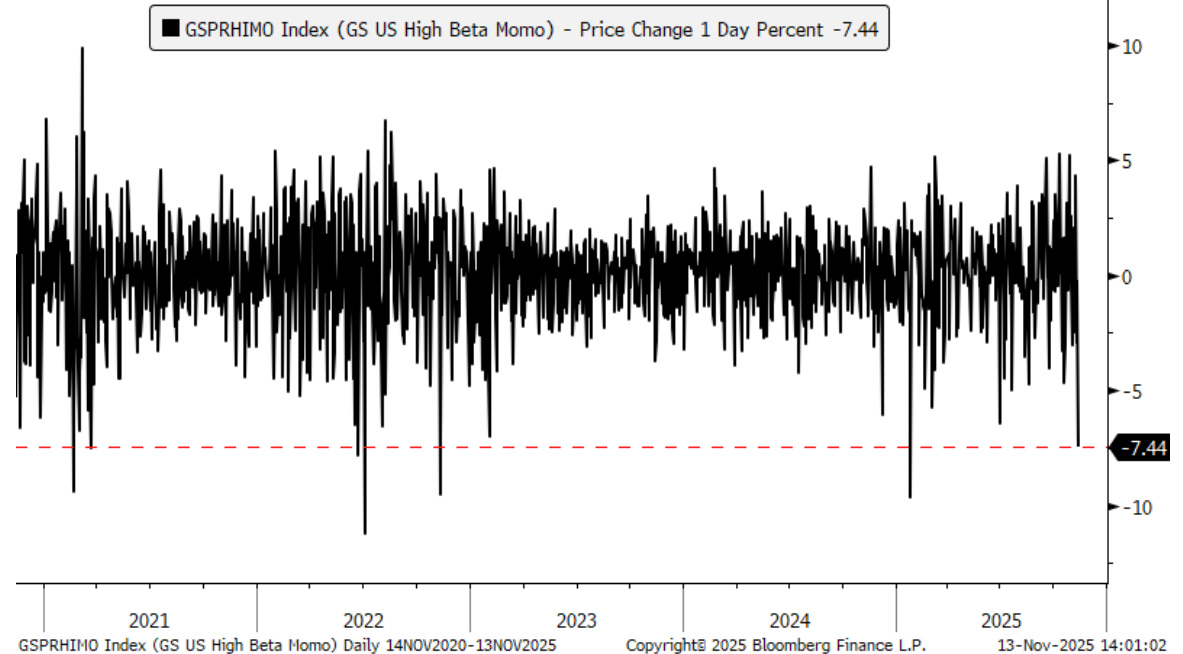

High Beta Momentum Pairs traded down -6.4% and had its second-worst day of the year and worst day since DeepSeek (1/27). The last time Mo’ traded down ~7% in a single session, the VIX was 45 (20 today).

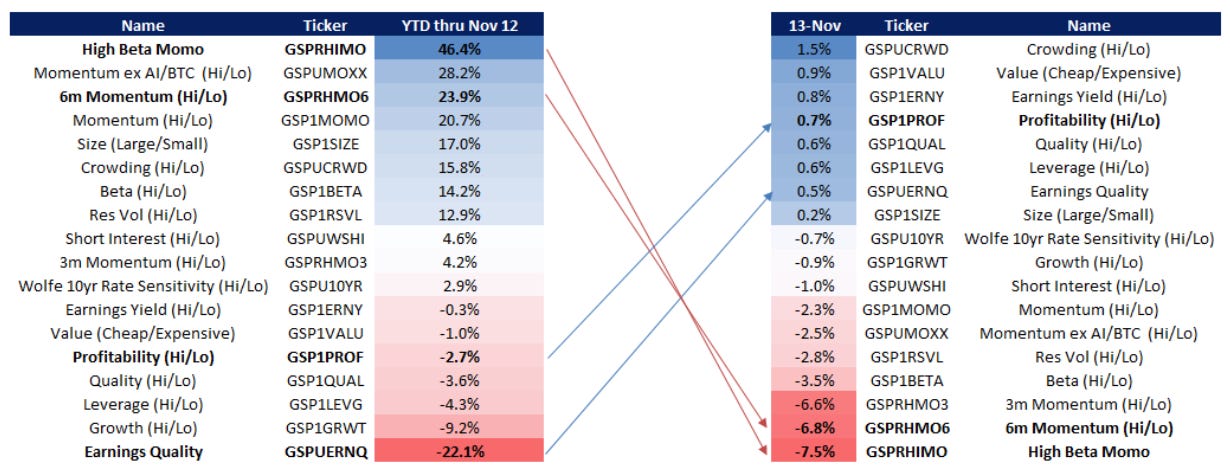

The AI complex and some of the most speculative areas of the markets were the themes most exposed to momentum and were selling off aggressively yday as we’ve seen large factor rotations in play.

“Headline roulette” is next around the macro data deluge that could come over the next three weeks ahead of the Fed. Hawkish recent data, delays and quality issues in employment reports, and consistently cautious signals from FED officials add to worries over the December cut.

Prime Intelligence

Last week we’ve made an article named “Concentration And Its Implications” that shared some insights into the significant divergence between sectors and how AI & big tech single handed carried the market higher over the last few months.

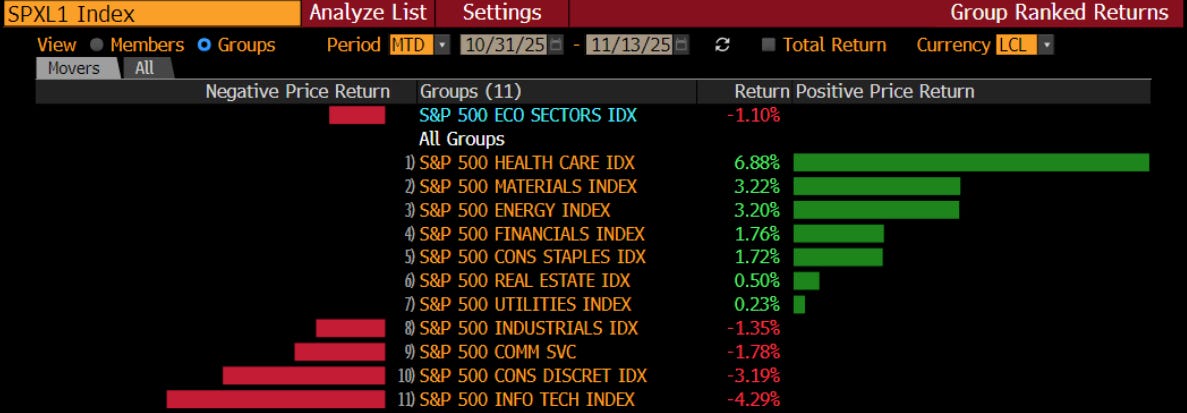

How it started: S&P performance in the first 10-months of the year. TMT up +23-30% vs Defensive sectors like HC, Staples.

How it’s going: November MTD performance HC up ~7% vs TMT down 4%. The “leaders” of this entire YTD rally getting hammered.

No matter the amount of capital rotation towards defensive sectors, which we’ve said the market is currently experiencing, the index isn’t going anywhere without the broader participation of these high-weight sectors.