The Market Brief

Hey team. U.S. futures dipped slightly on Friday as market participants weighed remarks concerning U.S. military engagement in the Middle East and took note of FED’s cautionary stance on the potential for increasing inflation.

Let’s see what’s ahead for this market!

Macro Viewpoint

Stock futures were lower ahead of Friday’s session, with investors monitoring conflict in the Middle East between Iran and Israel, and potential direct U.S. involvement.

Wednesday–Thursday, stocks closed lower following Powell’s comments, which essentially said that the Fed is in no hurry to cut benchmark rates and will remain data-dependent, especially as it remains unclear how Trump’s tariffs will impact the economy.

Wall St. Prime Intel

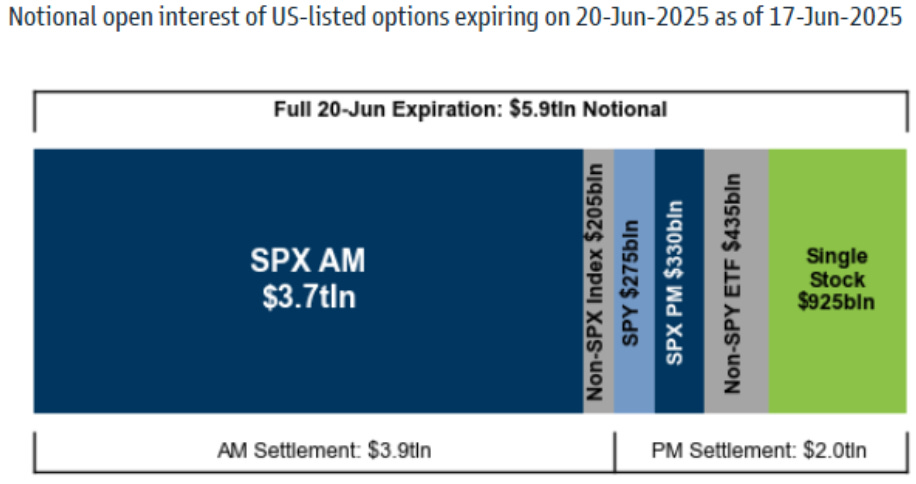

Today brings with THE LARGEST June options expiration in history.

We see estimates that over $5.9 trillion of notional options exposure will expire today, including $4.0 trillion of SPX options and $925 billion notional of single stock options.

What does this mean for you and the markets?

What do you need to be aware of?

How can this expiration affect the trend?

We answer these questions and much more in today’s brief👇

This is a free edition of the Market Brief. To receive our additional institutional-grade research, please consider becoming a paid subscriber.