The Market Brief

U.S. futures are near flat during early overnight trading as investors await fresh Fed signals ahead of a speech by Powell on Tuesday, with earnings season looming as the next big test for stocks.

Impact Snapshot

🟥 Services PMI - 9:45am

🟥 Fed Chair Powell Speech - 12:35pm

Macro Viewpoint

Just as we mentioned in our brief yesterday that the market had plenty of record closes ahead, which was a “bold statement” to many, we clocked yet another ATH on Monday.

Unlike the significant amount of social media larps that are allergic to math and try to spook you off with nonsense claims, our research is grounded in quantitative analysis (surprise, surprise) and statistical forecasting.

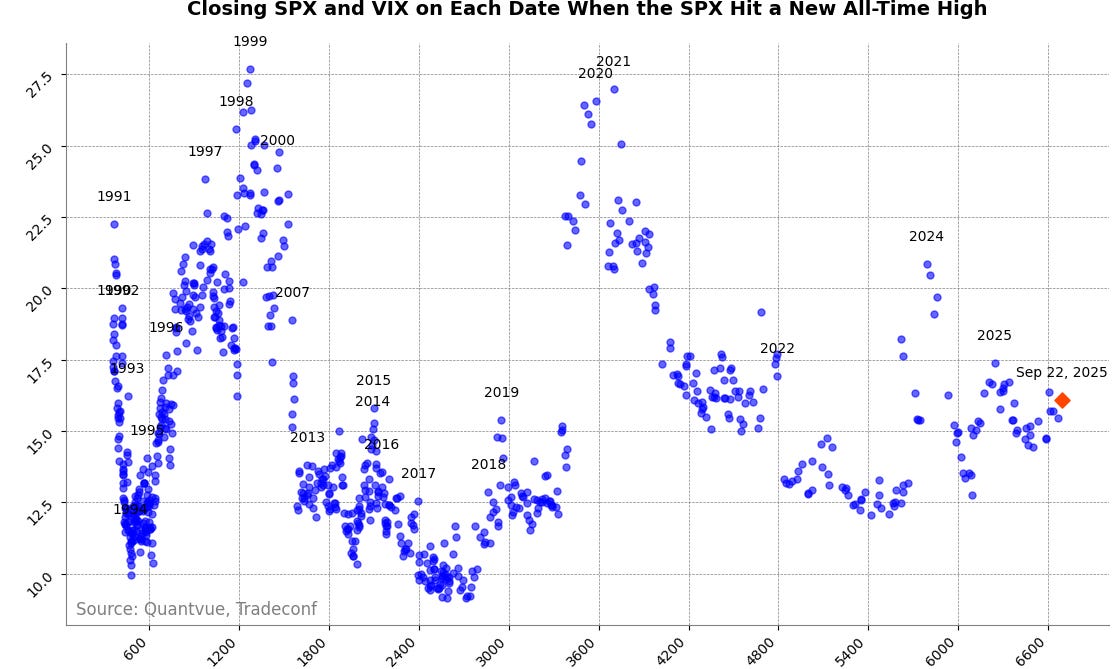

One interesting dynamic to track from here is how correlated vol outperformance has been with spot rallies. While we do expect this to happen at ATHs in the market, it is impressive to see vol firmly bid on moves of less than 20 bps, with the VIX refusing to fade here despite the SPX ATHs.

Prior Session Re-cap

By using a solid framework and understanding market context and its true intentions, we can identify significant opportunities and manage risk.

The following video is a replay of Monday’s U.S. session close, highlighting our context and references we shared at 5:00 am ET exclusively with our Subscribers

As we authored in our eBook, which our subscribers get access to, there is about a 65% chance you get a correction to the extreme overnight, in this case the ON was extreme short. The volume that occurs overnight is often no more than 25 percent of the volume experienced during the pit session hours. This means the overnight got too short in weak hand traders.

We had a lack of acceptance below our anchored VWAP, and now everyone that was “wrong” during the ON session had to “cover” their positions the moment we poked above the settle, triggering continuation.

“There was nothing up there.” Our first upside pivot was targeting an ATH. How can you “gauge” destinations when there are no historic prices to compare to so you can book your profits? We apply some of the concepts of order flow to monitor real-time behavior of absorption, as seen in our video.

No matter what trading strategy you use, honing your market reading skills by building solid frameworks and understanding context and nuances will significantly improve how you manage risk.