The Market Brief

U.S. stock index futures edged lower on Wednesday, ahead of a Federal Reserve monetary policy decision widely expected to deliver an interest rate cut.

Impact Snapshot

🟥 U.S. Employment Cost - 8:30am

🟥 Fed Policy Decision - 2:00pm

🟥 Powell Press Conference - 2:30pm

Macro Viewpoint

SPX closed modestly lower yesterday, despite outperformance from NDX and RTY. Overall, not much major shift in the macro narrative. JOLTS and ADP data both pointed to some positive signals in the labor market, but none of these are significant enough to change the Dec Fed sentiment.

Beyond Dec Fed, the NFP and CPI release next week will likely have greater impacts on Jan estimates.

FOMC Preview

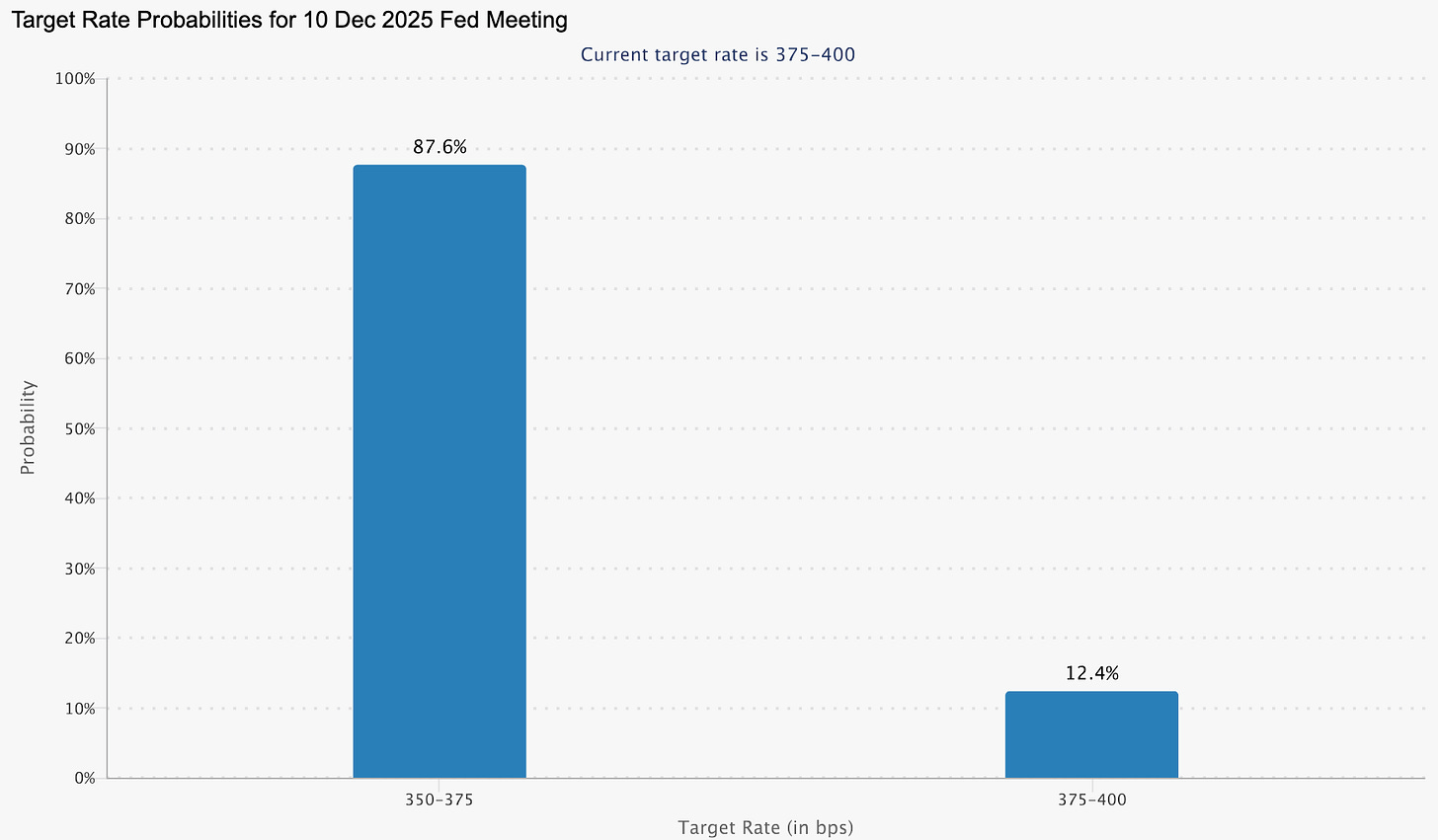

The FOMC is widely expected to deliver a third consecutive 25bp interest rate cut to 3.5-3.75% at what will likely be a contentious December meeting.

The case for a cut is solid. Job growth remains too low to keep up with labor supply growth, the unemployment rate has risen for three months in a row to 4.4%, other measures of labor market tightness have weakened more on average, and some alternative data measures of layoffs have begun to rise recently, presenting a new and potentially more serious downside risk.

⚠️ But the meeting will likely have a few HAWKISH elements..:

First, the statement will likely borrow the “extent and timing of additional adjustments” language used a year ago to convey that the bar for any further cuts will be somewhat higher.

Second, Powell will also likely get across that the bar has risen in his press

conference and will likely again make a point of explaining the views of

participants who opposed a cut.

📰 In today’s brief we’re highlighting all the risks we see in the market ahead and professionals are positioned ahead of the FOMC.👇