The Market Brief

US futures pulled back from all-time highs, with traders dialing back risk at the start of a relatively quiet week on the events calendar.

Macro Viewpoint

The S&P 500 clocked its 27th record close of the year on Friday, and there should be plenty more still to come as we have officially entered a cutting cycle.

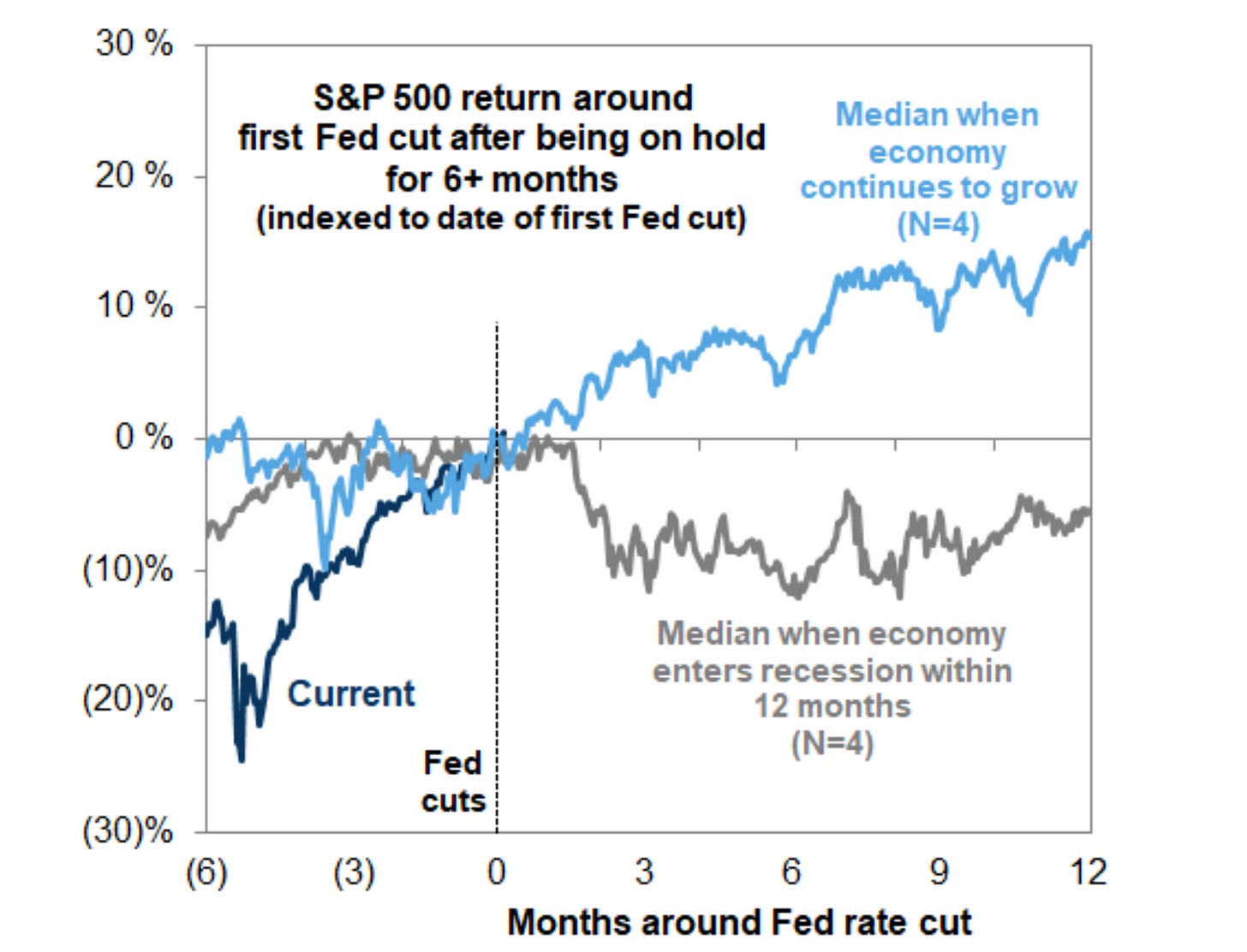

During the last 40 years, there have been eight episodes where the Fed cut after being on hold for six or more months.

In half of those episodes, the economy subsequently entered recession. In the other four cutting episodes, during which the economy continued to grow, the S&P 500 generated a median six-month return of +8% and a median 12-month return of +15%.

Prime Intelligence

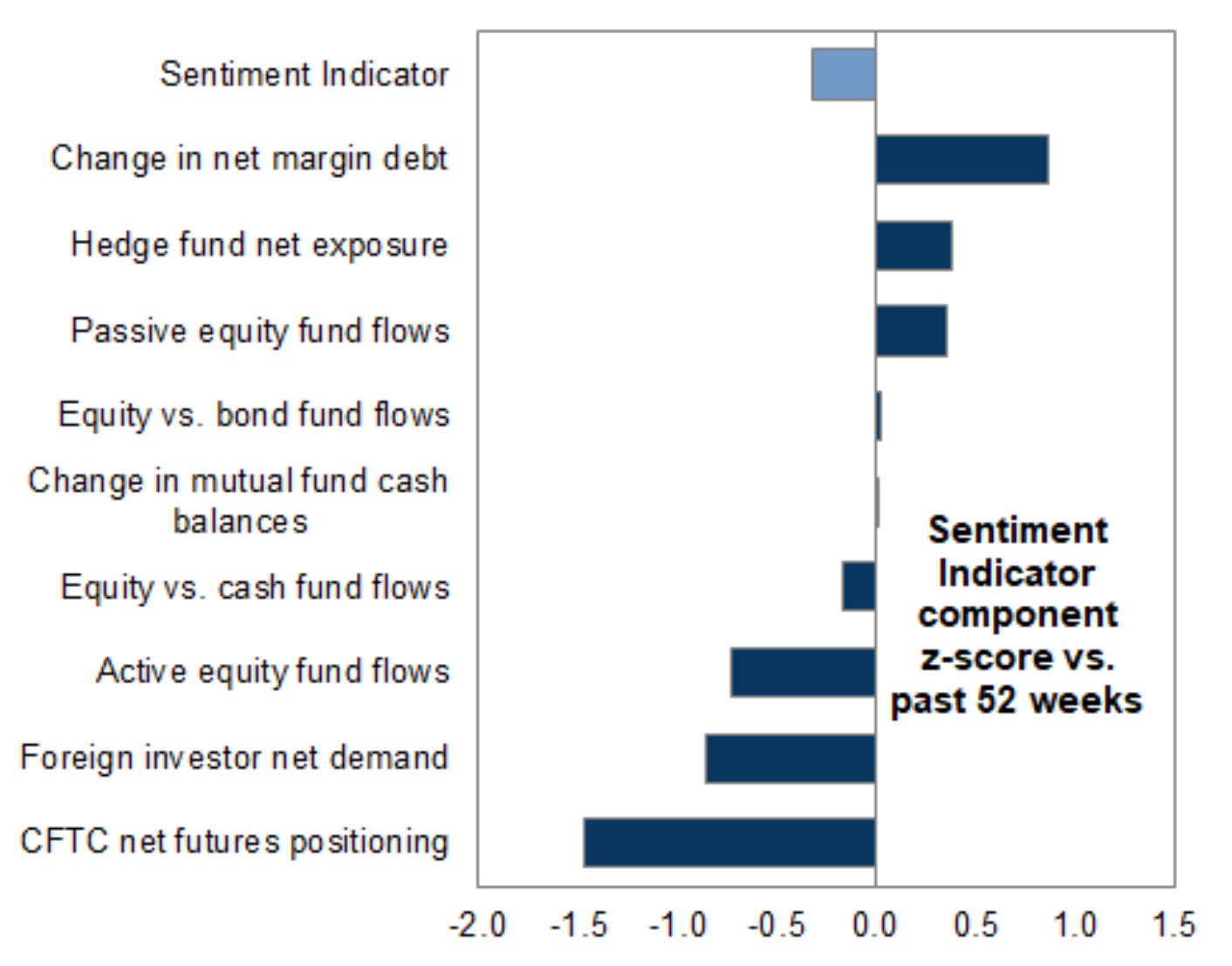

Positioning remains light relative to record-high index price levels. This could be the case that investors will try to catch their positioning up into year-end, which should continue to drive index-level prices higher.

Foreign Investor Net Demand and CFTC Net Futures Positioning standout as having the most room to catch up.

This is a FREE edition of the Market Brief. To receive our additional in-depth research and data analysis, consider becoming a paid subscriber. 👇