The Market Brief

Hey team. US stock futures edged higher ahead of crucial inflation data that is expected to show price pressures slowed last month.

Let’s re-cap the last session and see what’s ahead for the market!

Impact Snapshot

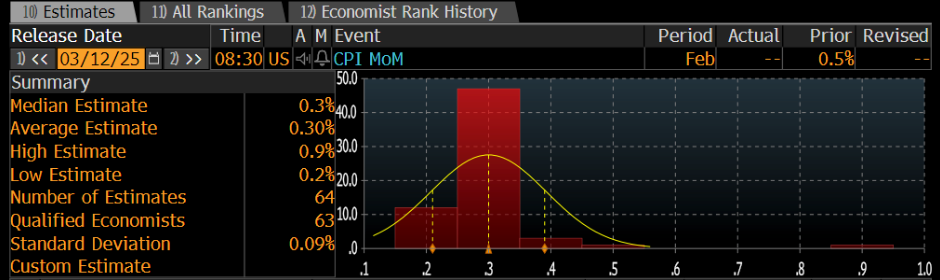

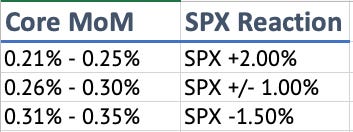

🟥 U.S. CPI Inflation - 8:30am

Macro Viewpoint

U.S. stock index futures edged higher on Wednesday, stabilising after recent volatility as investors evaluated the impact of President Trump’s tariffs on base metal imports. Attention now shifts to a key inflation report that could shape market sentiment.

CPI in focus

While the CPI is an important data point, broader concerns about U.S. economic growth have been the primary market driver in recent weeks.

CPI needs to be anything but very hot. If HF performance stays stable as momentum rebounds as experienced yesterday asset manager sell tickets we have seen since Monday will dry up again.

A meaningfully higher print – coming ahead of an expected upshift in inflation from tariffs – could lead the market to worry more about Fed constraints and the monetary policy “put”.

The primary concern isn't stemming from the Fed or economic data but rather from the effects of policy uncertainty, tariffs, and spending cuts.

The quickest path to stabilisation would likely involve a change in communication or messaging regarding Administration policy.

Expectation GS: 0.29%