The Market Brief

U.S. equity futures are cautiously higher as traders put worries about trade and credit behind them to focus on the next round of corporate earnings.

Macro Viewpoint

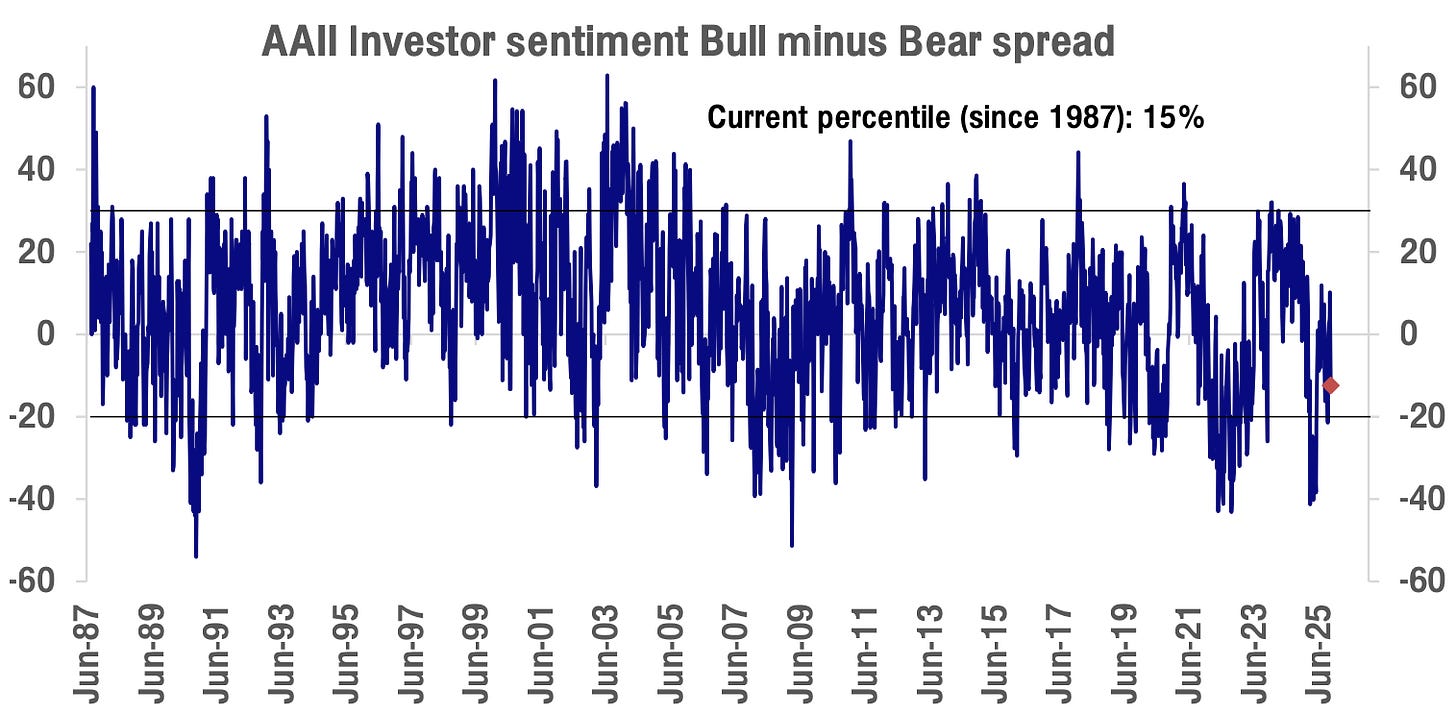

Investor sentiment improved as President Donald Trump sought to ease trade tensions with China.

Last week, sentiment fell to net bearish for the first time in four weeks, on the back of recent trade-related escalations. This marked the biggest weekly drop in sentiment since February.

This is not what you see before a market crash, with the S&P 500 trading roughly 1.5% away from a record high.

Prime Intelligence

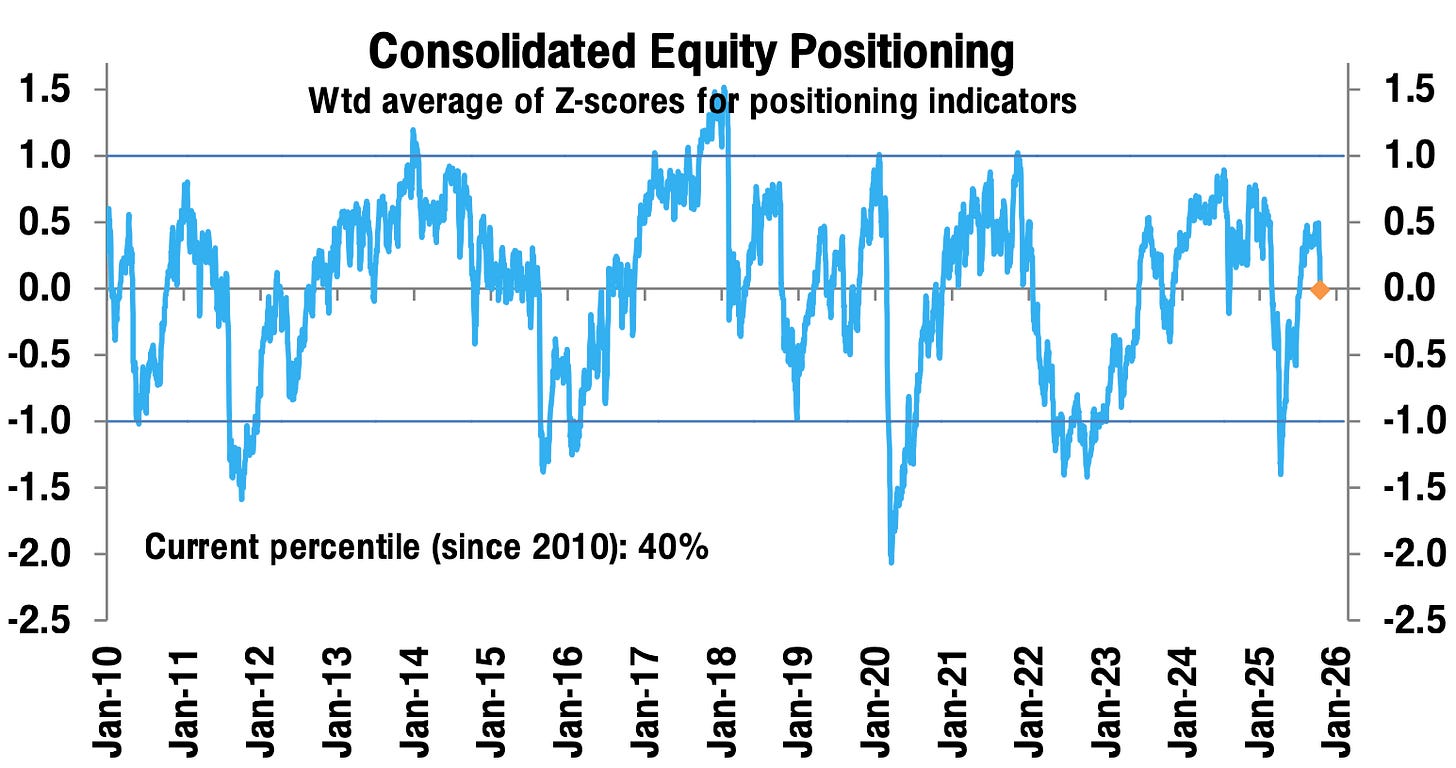

Overall equity positioning has tumbled since Oct-10, moving from moderately overweight to neutral in what was the biggest weekly cut since Liberation Day.

Discretionary investors, who have been primarily focused on risks for several months, moved from neutral to notably underweight. They are now positioned for negative earnings growth in Q3.

Their performance will likely suffer on the back of better earnings, which we believe will be the case.

📰 In today’s brief, we’re sharing the latest updated positioning of:

Systematic Strategies: Vol-control funds, CTAs, Risk-parity funds

CTAs Sell Triggers: Where our model forecasts unwinding to accelerate on S&P 500 & NASDAQ futures that can unleash billions of selling!