The Market Brief

U.S. futures cautiously higher early Tuesday, steadying after losses in the previous session as investors await more data to determine the Fed's next monetary policy move.

Macro Viewpoint.

U.S. stocks kicked off December on a dour note, with the three main indexes marking their first daily losses in more than one week on Monday, pressured by a tick-up in Treasury yields.

The moves offered relief after a shaky start to what is typically a strong month for equities.

Focus now shifts to the Federal Reserve for clues on the US rate outlook at next week’s meeting, with markets treating a cut as all but certain.

Prime Intelligence

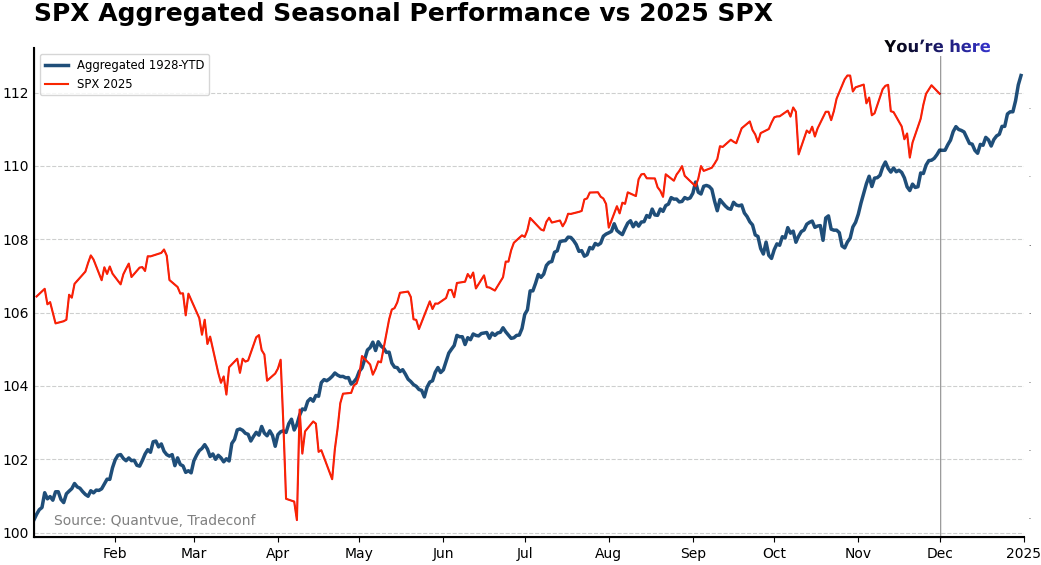

Retail investors are slowly dipping back in the markets, but history suggests the first half of December often brings a bit more turbulence on the way to the holidays.

Seasonal trends get plenty of airtime this time of year, and while they’re generally supportive, the path isn’t typically a clean, uninterrupted move higher.

December’s average returns are positive, but the early part of the month has historically been choppier for both the S&P and Nasdaq. The back half of December, however, has been consistently strong for both indices, we just need to navigate the near-term volatility first.

📰 In today’s brief we cover

Volatility and its role in today’s markets

Systematic thresholds to watch for unwinding

Retail positioning and their flows

Gamma levels and regime

We cover all the above and much more in today’s market brief 👇