The Market Brief

U.S. futures saw muted movement across most markets, as investors held back on big bets ahead of Wednesday’s Federal Reserve interest-rate announcement.

Impact Snapshot

🟥 Federal Funds Rate - 2:00pm

🟥 FOMC Press Conference - 2:30pm

Macro Viewpoint

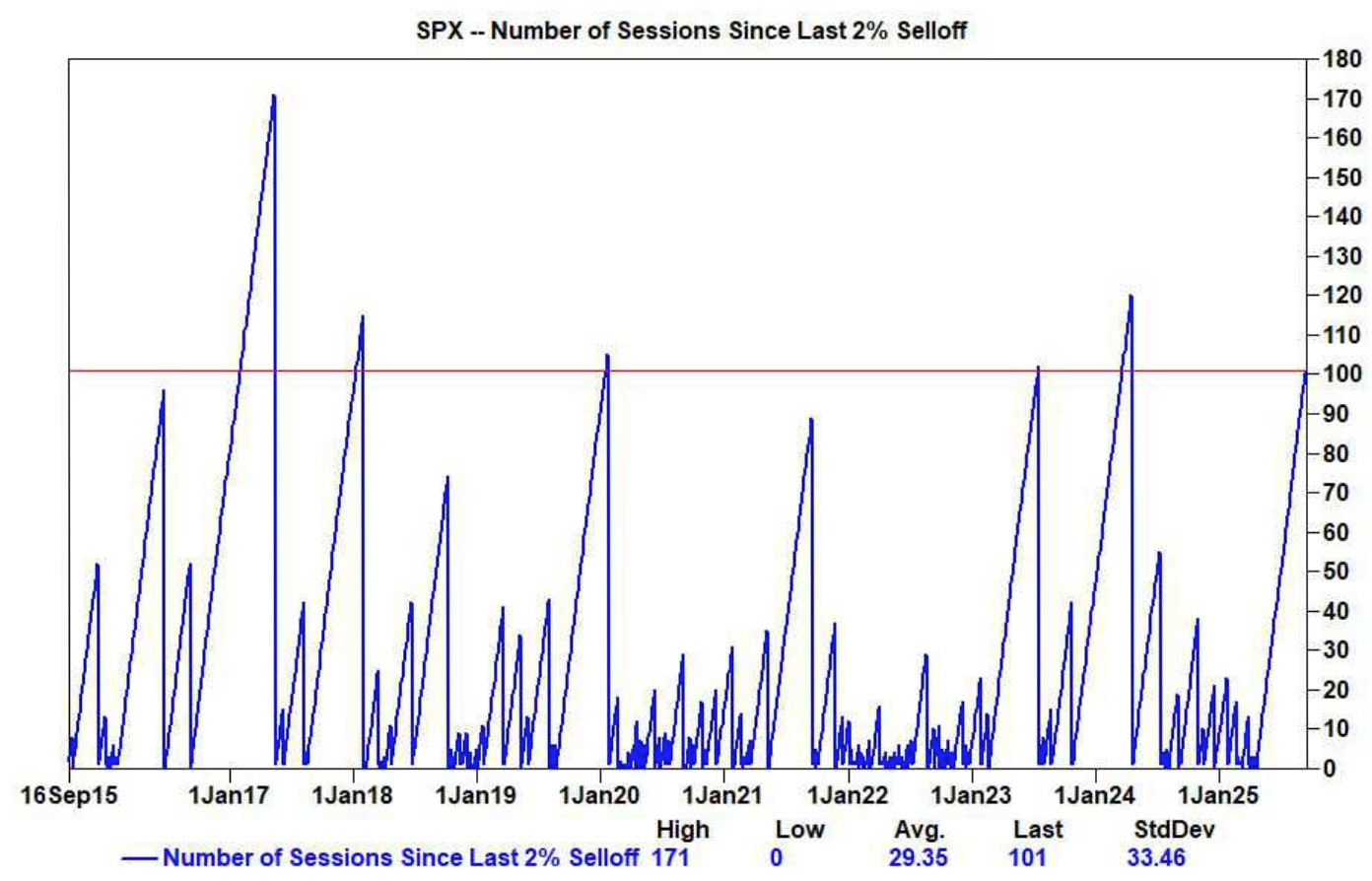

Despite the S&P 500 continuing to reach new all-time highs, the US equity flows story has been a persistent drag on positioning metrics. We’re now at one of the longest streaks without a -2% selloff, and it’s been over 100 days.

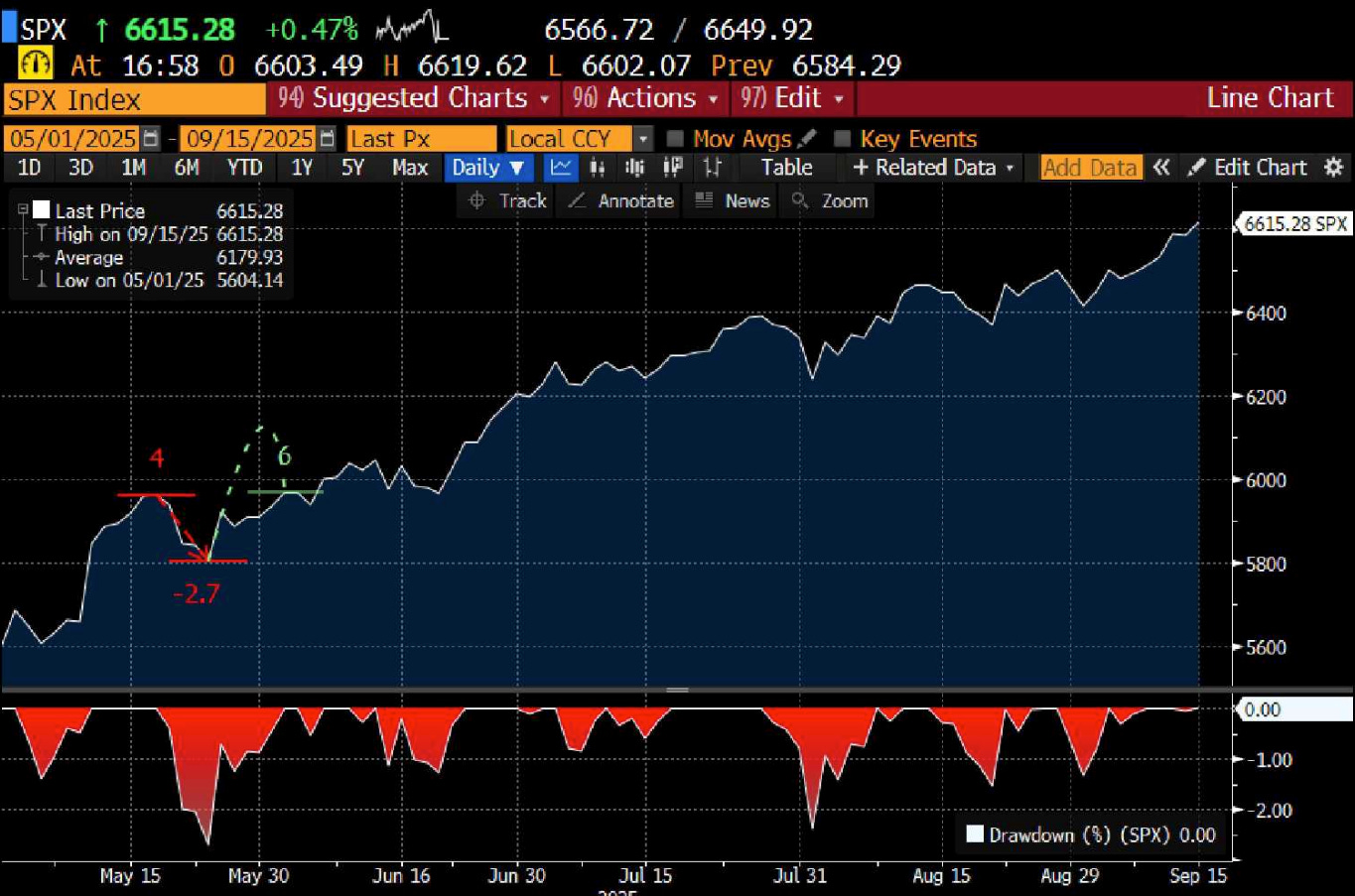

This underscores the frustration that some have felt, waiting for a dip to buy that really hasn’t come. The largest drawdown the S&P has seen since the beginning of May was -2.7% during a 4-day span.

TRADING THE FED

The market is expecting a 25 bps rate cut, with 2–3 potential dissenters who would be looking for at least 50 bps of cuts, and then 3 consecutive cuts from Oct 2025 – Jan 2026.

At the press conference, Powell is likely to focus on downside risks to employment, given that tariff-induced inflation is expected to be transitory. Here are the potential outcomes and what you should be aware of when following up on market reaction:

FED HIKES – SPX falls 2% – 4%.

FED REMAINS PAUSED – SPX falls 1% – 2%.

HAWKISH 25BP CUT – SPX is flat to down 50bp.

DOVISH 25BP CUT – SPX gains 50bp – 1%.

50BP CUT – SPX loses 1.5% to SPX gains 1.5%

SPX options are pricing in 88bp move for options that expire on September 17, based upon data as of Sep 12.