Turning Tides

Hey team. We’re back with another market report where we re-cap last week’s events and see what’s next for the markets!

Impact Snapshot

FED FOMC Minutes - Wednesday

Unemployment Claims - Thursday

Manufacturing/Services PMI - Thursday

Fed Chair Powell Speaks - Friday

Jackson Hole - Friday

Market Evaluation

U.S. stocks climbed on Friday, wrapping up the strongest week of 2024 as investors rebounded from a sharp downturn that marked the start of August.

The pace of consumer inflation unexpectedly slowed last month, posting the smallest increase since March 2021, while producer prices grew less than expectations.

Additional key economic data released during the week revealed that retail sales in July exceeded expectations, while weekly unemployment insurance claims unexpectedly declined, ease concerns regarding an economic downturn.

Markets are now pricing in a roughly 75% probability that the Federal Reserve will cut interest rates by 25 basis points next month, with the remaining odds being in the favor of a more aggressive 50-basis-point reduction according to CME FedWatch tool.

Wall Street is anticipating that Federal Reserve Chair Jerome Powell will confirm the upcoming interest rate cuts during the central bank’s annual gathering in Jackson Hole.

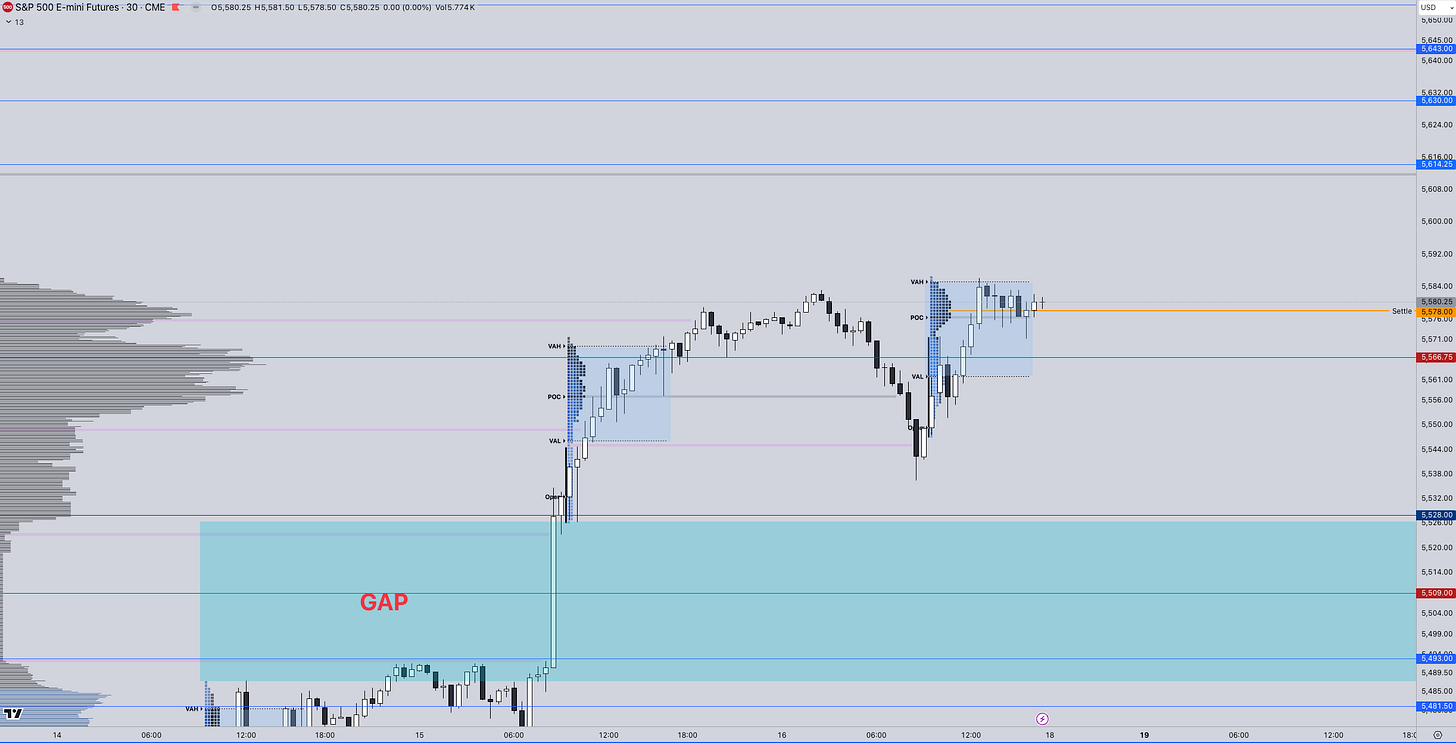

Markets Breakdown

The emotional downside at the start of the month was met with a complete roll-over bringing us nearly back to full recovery.

From the-worst market sell off we’ve seen in recent years to the-best week of 2024, emotional trading and volatility are far from over.

Friday’s session was a textbook example of why focusing on where the market is trying to build value is more important than getting emotionally attached to price.

On our market report prior to the US open here, our outlook highlighted that the value was higher and the potential range formation being underway around Thursday’s range despite the market being down over 30 points. Read update here.

As we always say, markets going from an imbalance state, constantly seeking fair value, back to balance and they anticipate a catalyst to break from that balance.

We’re now on a potential range formation stage with the market’s main focus point being the Powell’s speech to close the week on Friday which volatility will certainly pick up.

It is not uncommon for traders to buy a momentum driven rally and later on sell the news.

ES

Some references we’ll be looking going forward:

Upside Levels: 5614/5630/5643

Downside Levels: 5566/5528/5509

That’s all we got!

Like this post, share it with a friend.

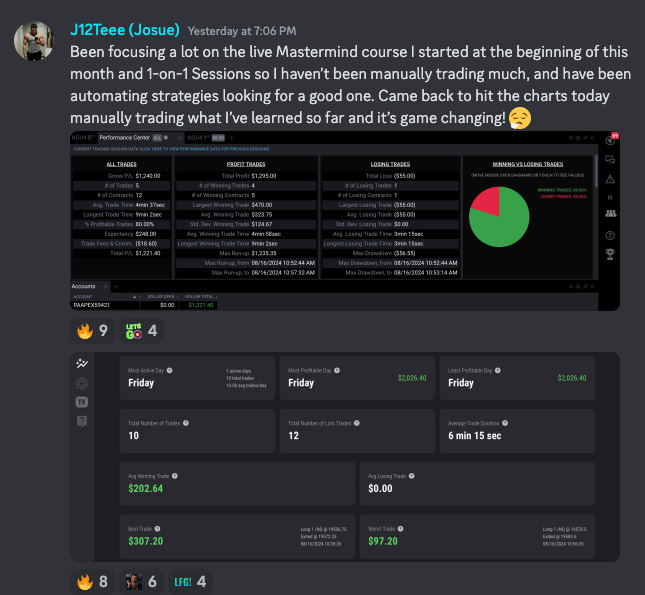

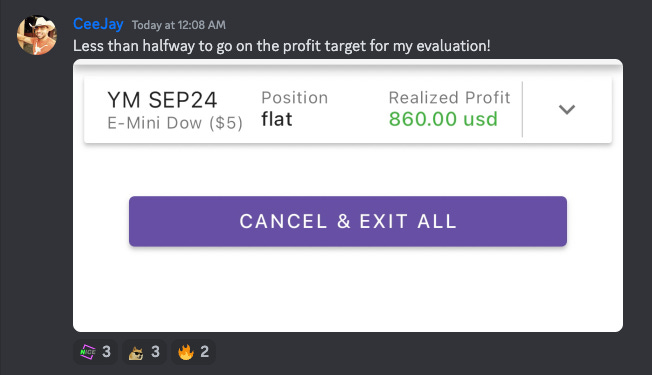

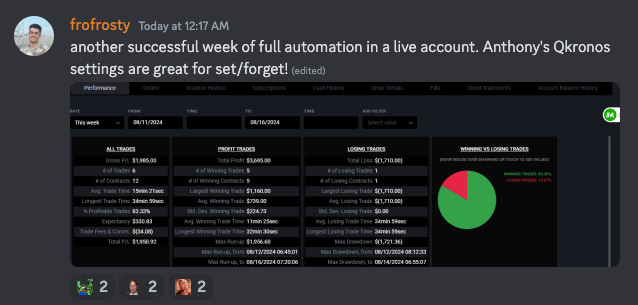

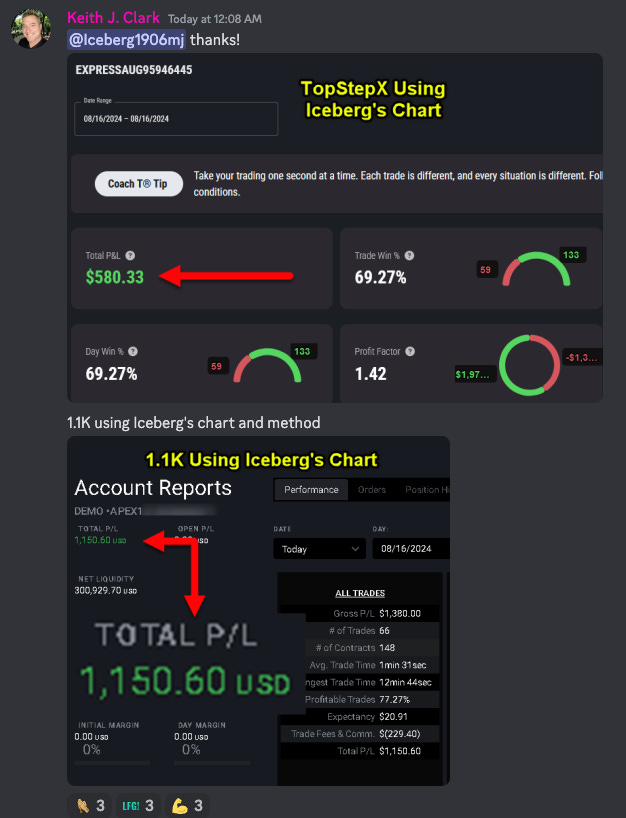

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.