Uncertainty Overload

Hey team. A packed schedule of U.S. corporate earnings in the upcoming week is set to challenge a stock market already rattled by recent changes to U.S. trade policy, which have disrupted expectations for both the global economy and American businesses.

Let’s see what’s ahead for the markets!

Impact Snapshot

Flash Manufacturing PMI - Wednesday

Unemployment Claims - Thursday

Consumer Sentiment - Friday

Key Earnings: TSLA 0.00%↑ VZ 0.00%↑ BA 0.00%↑ T 0.00%↑ GOOGL 0.00%↑

Macro Viewpoint

S&P500 stock index fell this week and was down 14% from its February record high.

Investors continue to struggle against on-again/off-again US policy oscillation and comb through data of the early Q1 earnings reports for signs of whether (and how much) of the economic damage from elevated uncertainty has already been done.

Headline roulette continues, and substantive dialogue with China remains impaired, but one can argue that we’ve passed the point of maximum uncertainty.

The worst of all worlds

The lingering market fear right now is stagflation. It’s the worst of all worlds. It’s a combination of stagnant economic growth, high unemployment, and persistent inflation.

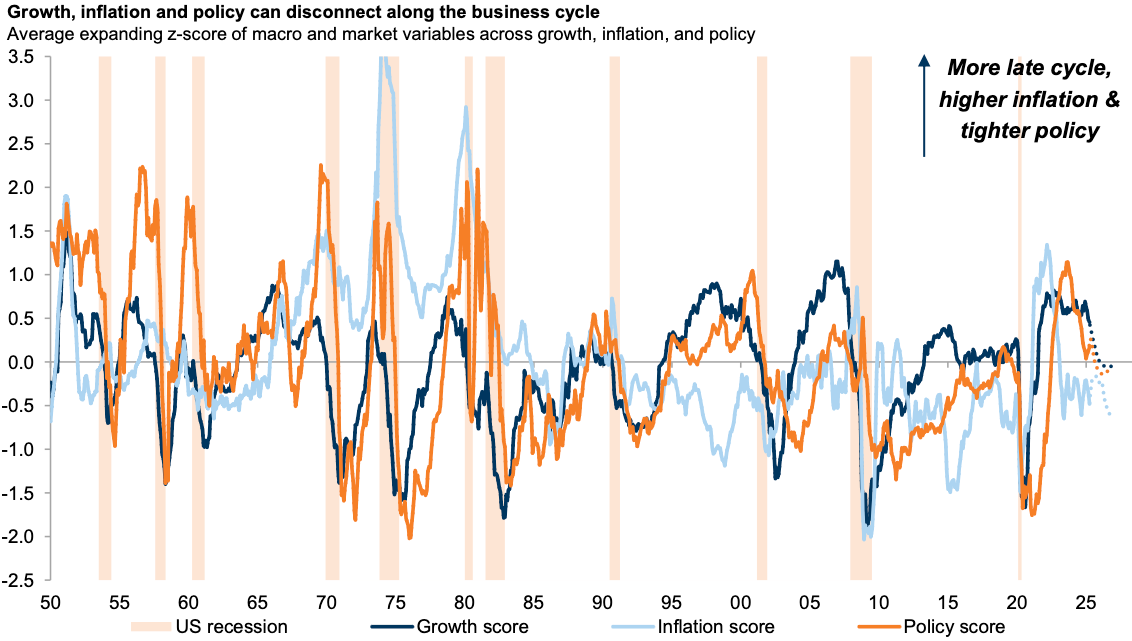

US macro baseline has become less friendly and points to stagflation according to Goldman Sachs investment research.

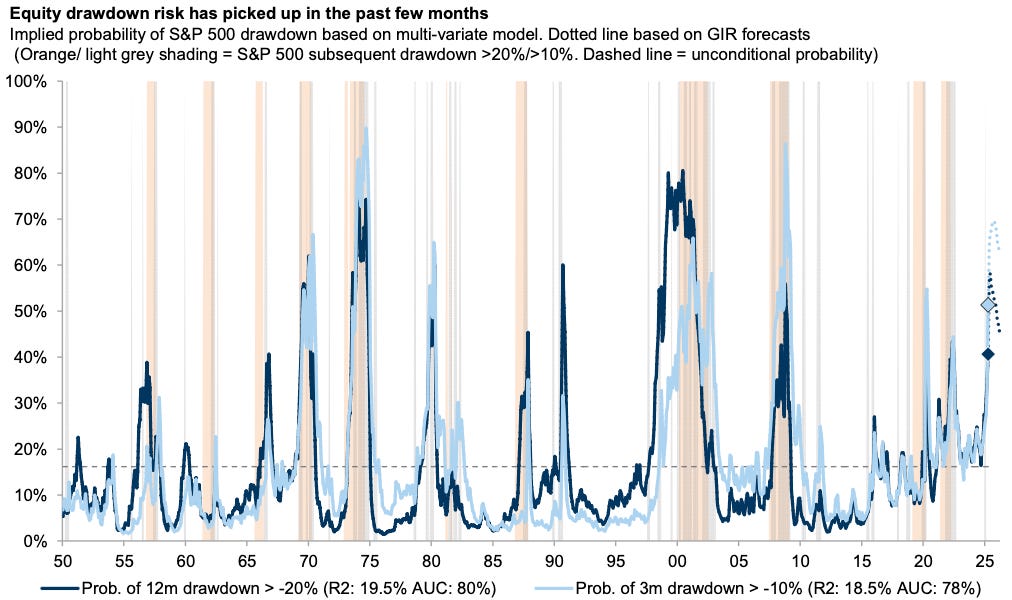

The equity drawdown risk remains elevated and has not peaked yet. Negative risk metrics and high policy uncertainty also increase drawdown risk. As we like to say very often in our market reports, you will know the lasting low well after the fact.

Wall St. Prime Intel

Average daily volume this week was about half of the prior week as we saw a clear slowdown of the volatility in contrast to the prior week.

In today’s in-depth weekly edition, we cover:

Institutional & Retail Flows: Have we seen any evidence of asset managers adding exposure to this market, or is it mostly retail?

CTAs Positioning: Did the trend-following innovators of this historic sell-off change their positioning moving forward?

Prior Session Deep Dive: Market nuances and a complete overview of the last session.

This is a free edition of the Market Brief. To receive our additional in-depth research and data analysis, please consider becoming a paid subscriber.