Value Edge

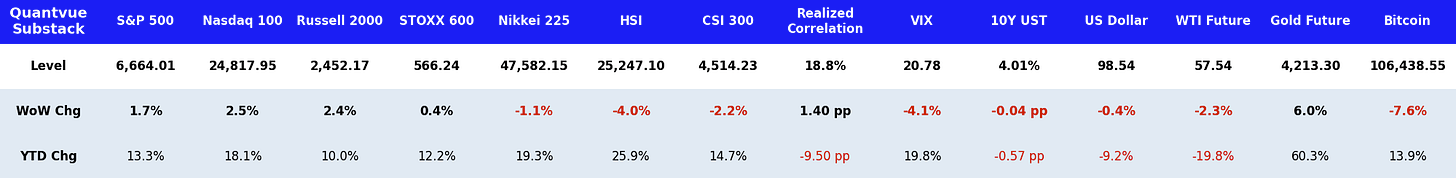

While US stocks finished higher, this week brought increased volatility as the start of Q3 earnings was met with mounting geopolitical risks and credit concerns.

Macro Viewpoint

The S&P 500 index rose 1.7% this week as earnings season kicked off on a largely positive note and President Donald Trump said his proposed 100% additional tariffs on China are “not sustainable.”

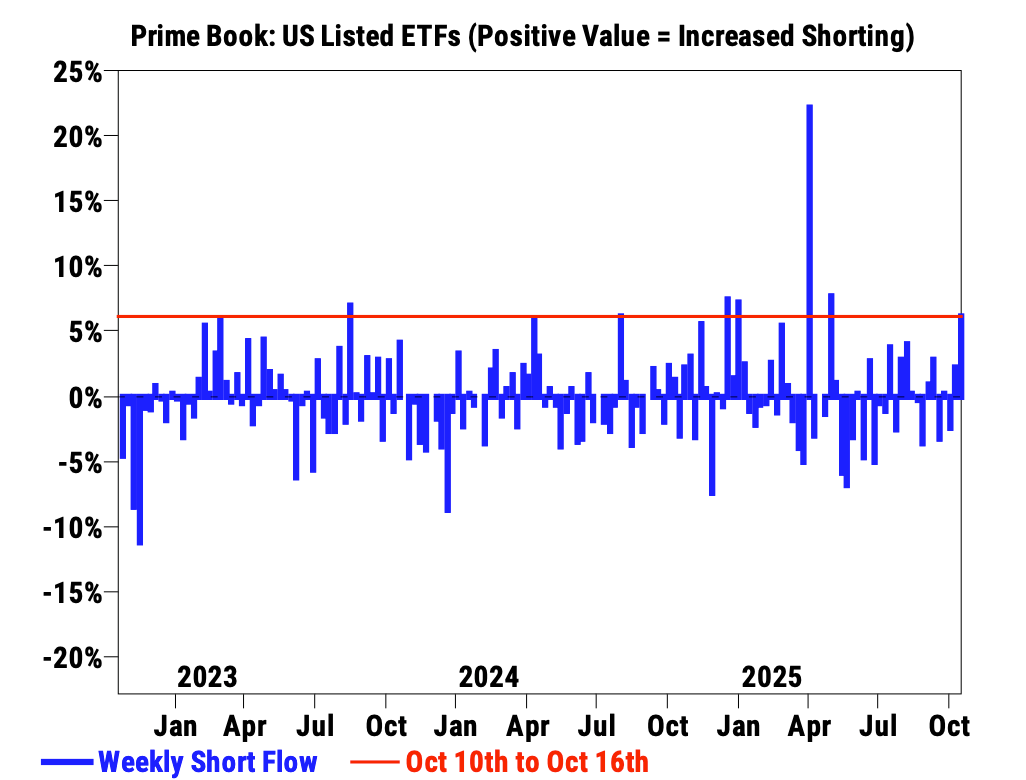

We’ve seen hedge funds net selling US equities at the fastest pace since early April. US ETF shorts saw the largest percentage increase in over five months.

S&P implied move through next Friday (10/24) is 2.31%. Busier earnings week as well, with 18% of S&P market cap reporting. Some of the key earnings include: NFLX 0.00%↑ KO 0.00%↑ GM 0.00%↑ TSLA 0.00%↑ IBM 0.00%↑ T 0.00%↑ INTC 0.00%↑ AAL 0.00%↑ LUV 0.00%↑ F 0.00%↑ PG 0.00%↑

On the macro front, the market is expecting a delayed September CPI print on Friday, as economic data remains light while the US government shutdown continues.

Looking Beyond Price

Price alone lacks context; it is the surrounding market structure that gives it meaning. Traditional bar charts often fail to capture the full depth of market activity.

By focusing on the underlying dynamics, where the market has established fair value and where it begins to move away from that equilibrium, you can identify higher-probability opportunities, improve profit-taking consistency and saving yourself from absolute disaster. All these came into play on Friday.

All the context and pivots in the following video were shared with our subscribers during the ON session and at the time the video starts.

No headlines, no tweets or anything in between could have came out at the time we shared our brief. See what we saw hours before the fact and how the market unfolded afterward relative to our context.

📰 In today’s brief, we’re revealing the EXACT mindset behind our market plan, why we anticipated the potential full retracement higher, and how it turned into one of the best setups in weeks!

We’re putting you on the driver’s seat and share the same decision‑making framework, step by step, that let us anticipate this move so you can spot these moves in real time yourself. 👇