Volatile environment continues

Hey team. One of the most exciting weeks for the markets across the globe has ended. Let’s re-cap last week’s events and see what’s next for the market !

Impact Snapshot

PPI Inflation - Tuesday

CPI Inflation - Wednesday

Retail Sales - Thursday

Unemployment Claims - Thursday

Consumer Sentiment - Friday

Market Evaluation

This week has been the most volatile for the market in 2024.

The S&P 500 kicked off the week with a 3% drop on Monday, its steepest one-day decline since 2022, driven by escalating recession concerns following disappointing July jobs data.

However, better than expected weekly jobs data helped the index jump 2.3% on Thursday, its largest one-day gain since 2022.

These wild swings brought the Volatility Index (VIX) to levels not seen since the height of the pandemic in 2020.

The main reason behind that volatility was the disappointing U.S. payrolls data from the prior week and concerns the Federal Reserve was too late with rate cuts.

Another key reason being the unwinding of the Yen carry trade, a popular currency trade by hedge funds.

The markets made a return to close the week after the latest US labor-market data helped ease concern about whether the Federal Reserve is easing fast enough to head off a potential recession.

All eyes on this week’s consumer prices report, which traders hope will give the Federal Reserve the confidence it needs to begin cutting interest rates at its next meeting in September.

Markets Breakdown

A unique week for the market has been concluded, triggered by emotions and speculations which saw market swings of 100 points like it was nothing.

As we often say, when an emotional session is underway, it discounts everything.

If the market is on a downtrend and the downside continuation is bringing higher volume, it means that the auction to the downside is not complete and lower prices continue attracting new sellers.

You can build a framework of potential outcomes and be prepared, which is what we’re doing and showcasing every single day on our X feed. Read Friday’s update here.

We ended the week just shy of completely reversing its weekly losses.

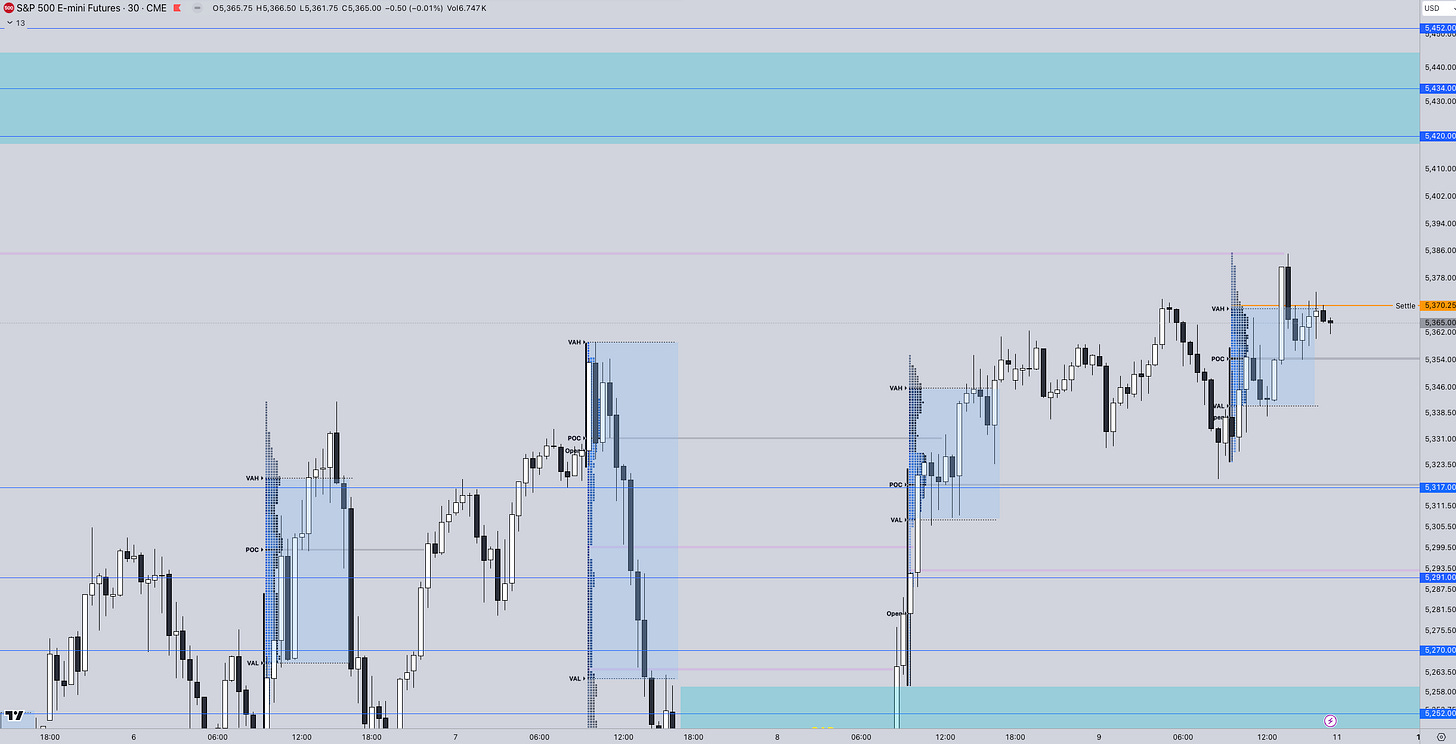

Moving forward, the market is well within a balance range formation on an attempt to break from the balance and the key upside reference to watch is the previous gap which the market has a lot of room to go towards to.

A rejection off of the balance highs will lead into a complete roll-over heading into next week if the market loses the 5317 which will trigger a rotation towards the other end of the balance.

ES

Some references we’ll be looking going forward:

Upside Levels: 5420/5434/5452

Downside Levels: 5317/5291/5270

That’s all we got!

Like this post, share it with a friend.

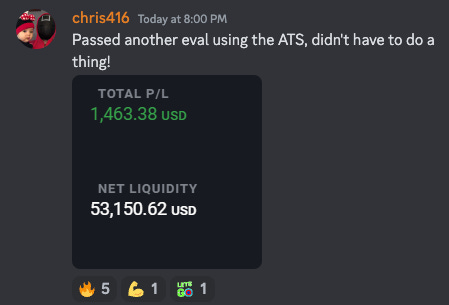

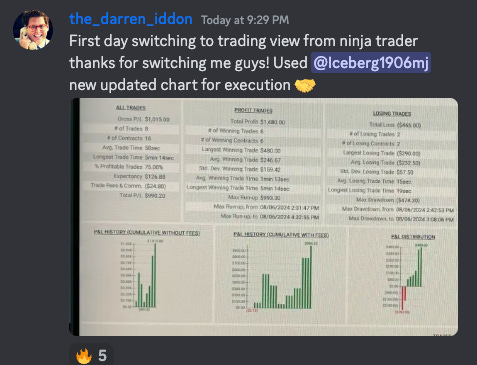

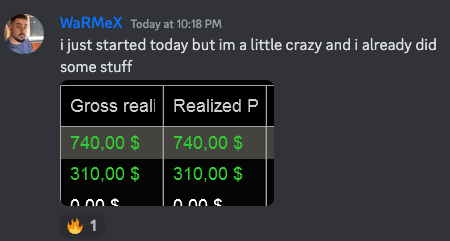

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

QuantVue ATS - Prop Automation Program

AUGUST ATS AVAILABILITY UPDATE: 1 spot left

Join 125+ clients automating their futures prop firm trading with the QuantVue ATS (Automated Trading Suite).

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.