Volatility Ahead

Hey team.

We've got another market brief on $ES for you.

Let’s re-cap today’s session and see what’s next for the market!

Impact Snapshot Tomorrow

PCE inflation - 8:30am

Chicago PMI - 9:45am

Revised Consumer Sentiment - 10:00am

Market Evaluation

U.S. stocks ended higher on Thursday, with the S&P 500 and Nasdaq scoring a three-session win streak ahead of the quarter's end.

Investors will be focused on Friday's PCE inflation report for May, as well as the end of a strong second quarter.

The U.S. economy’s performance in the first three months of the year didn’t look much better the third time around: The government’s latest estimate of first-quarter annual growth was lifted slightly to 1.4%.

Traders gearing up for the Fed’s favoured inflation gauge piled into Treasuries as several data points illustrated a downshift in growth tied to the central bank’s higher-for-longer stance.

Sierra Suite

Want to detect real-time absorption from institutional traders orders? Here's an example: Large market orders from sellers hit the Bid at 5530, but strong passive buyers absorbed them, leading to an upward rotation. Our footprints, included in the Sierra Suite, highlight all the crucial details to enhance your decision-making context.

Markets Breakdown

The end of quarter paired with Fed’s favoured inflation gauge will see a change of theme in contrast of what we’ve been seeing the last couple of days.

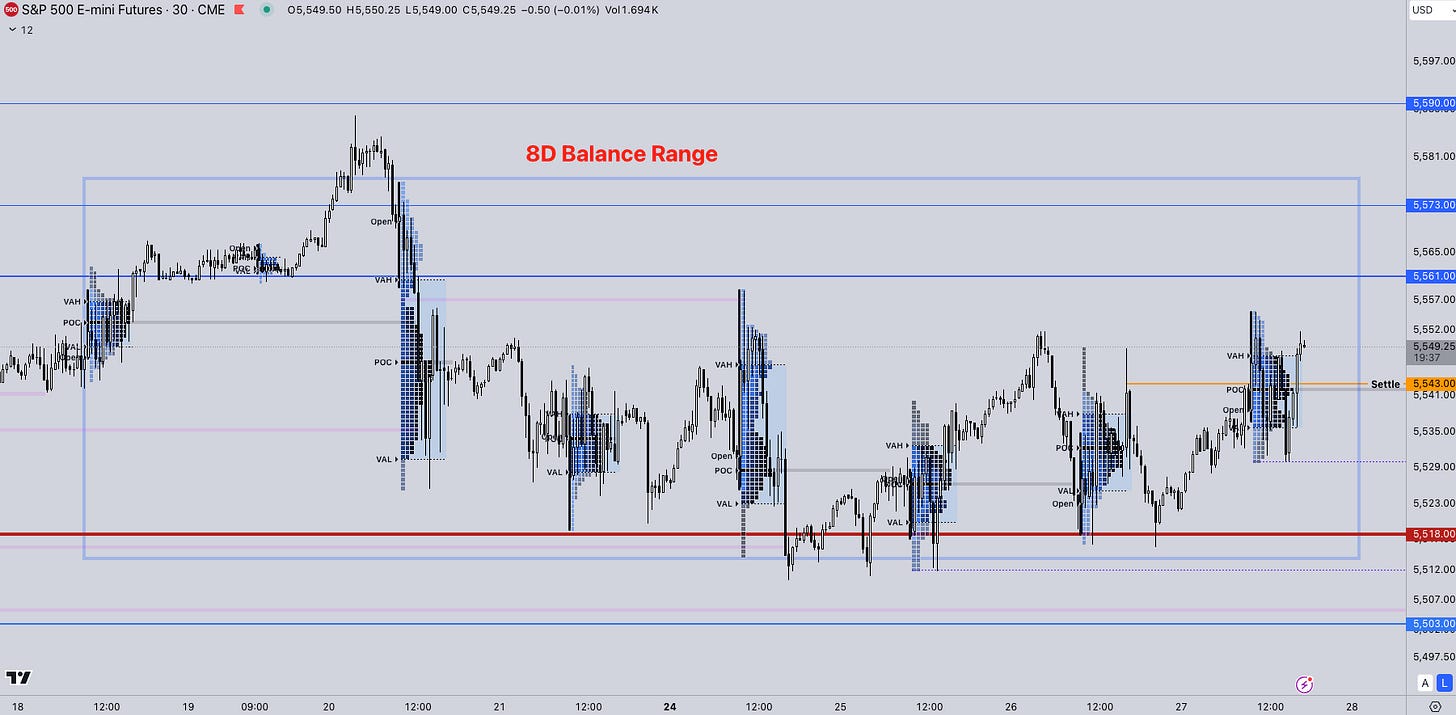

We always say that markets range/balance until there is some type of catalyst to break out from that balance. The longer you spent and “coil” on a range, the more volatile the move out of it is going to be.

Today’s session kept the same theme that we’ve had since Monday with range-bound activity which remained within balance without enough conviction on either side to drive any major directional move.

Heading in tomorrow’s session we’ll be managing risk at 8:30am as the potential PCE number will see a directional swing which will likely be followed by another equal swing in the opposite direction which a common market behaviour at key economical releases.

ES

The targets we’ll be looking throughout the overnight:

Upside Levels: 5561/5573/5590

Downside Levels: 5518/5503/5482

That’s all we got!

Like this post, share it with a friend.

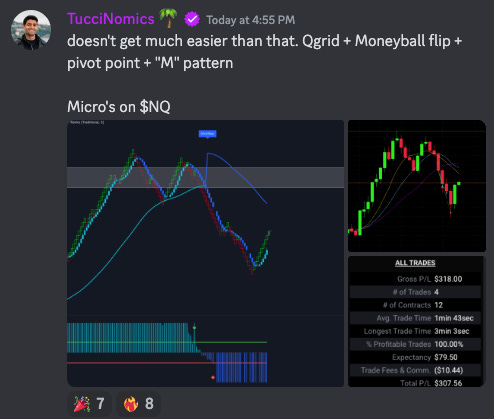

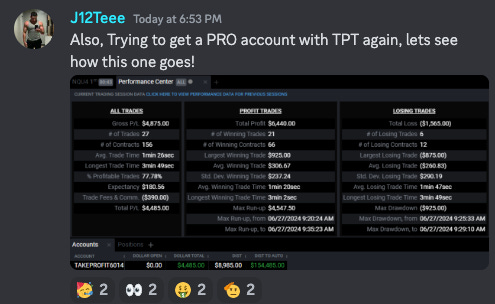

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.