Volatility Ahead

The market is anticipating the key inflationary number due tomorrow, and volatility is expected. Let’s recap today’s session and see what’s next!

Impact Snapshot

CPI Inflation, Wednesday - 8:30am

Harris-Trump debate scheduled for 9 p.m.

Market Evaluation

The S&P 500 recorded its second consecutive gain on Tuesday as Wall Street tried to steady itself amid a volatile September.

Megacap tech and tech-related stocks helped boost the Nasdaq , while the S&P 500 posted a more modest gain and the blue-chip Dow finished in the red.

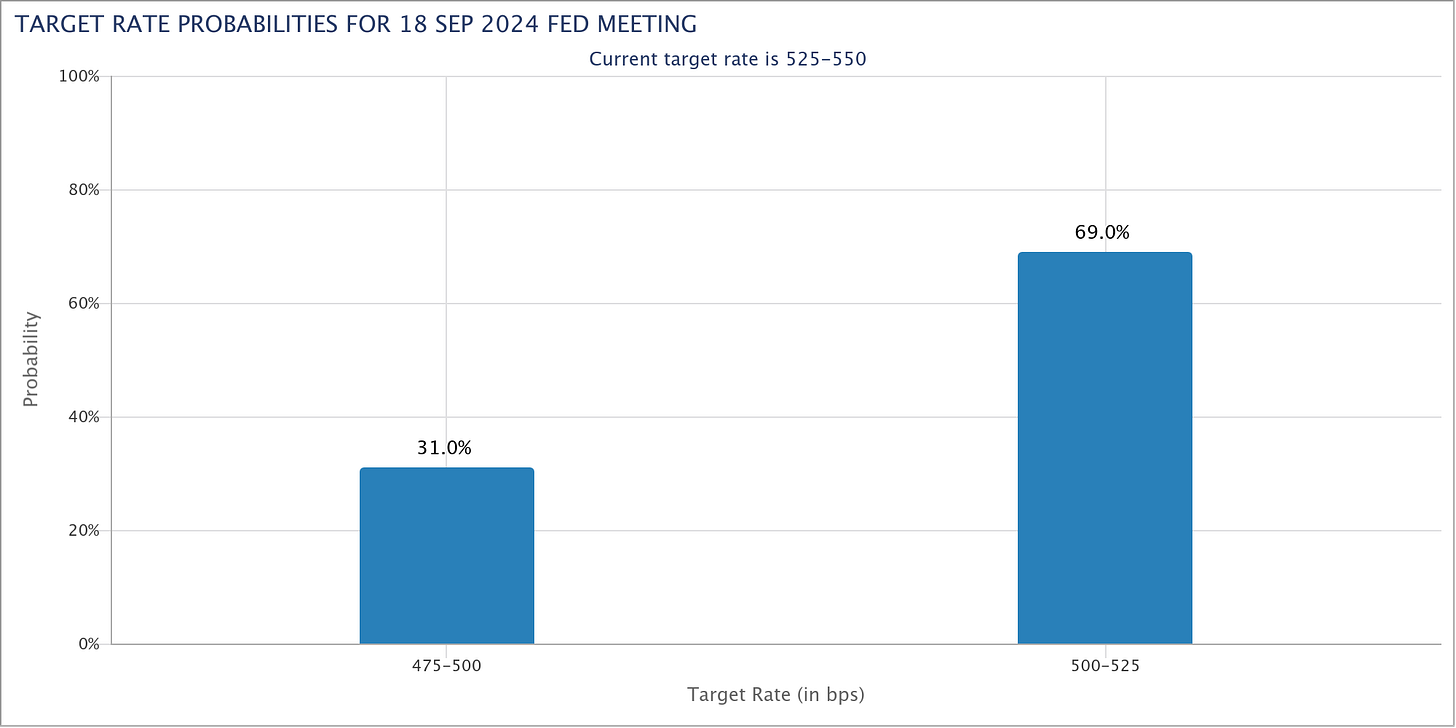

Financial markets are pricing in a 69% probability that the central bank will lower its Fed funds target rate by 25 basis points at the end of its monetary policy meeting next week, while assigning a 31% chance to a larger 50 basis point rate cut.

Wednesday's CPI report is anticipated to indicate inflation moving closer to the Federal Reserve's 2% target, supporting Fed Chair Jerome Powell's view that price growth is under control.

Markets Breakdown

With the market anticipating the all-important CPI inflation number due tomorrow, our expectation for Tuesday was that a range would form within last Friday’s values.

More often than not, when the market is anticipating a key catalyst, it will try to balance itself within a consolidation range instead of attempting to break out.

After a rejection off our first upside pivot, which resulted in a 52-point rejection (read initial update here), the market made a complete recovery towards the US open.

The key observation here is that the market has been building value to the upside over the last two days, indicating acceptance of higher prices.

The primary focus for buyers will be to establish acceptance inside the 5500s and aim for continuation toward the previous multi-day balance lows.

Bears will see another rejection, which could lead to a decline towards Friday’s lows. It’s important to understand that this would signal a 4-day balance formation, and the balance guidelines would once again be applicable.

Exercise caution, as the market will most likely enter an emotional state during the presidential debate, and the CPI release is due at 8:30 a.m.

ES

Some references we’ll be looking going forward:

Upside Levels: 5527/5546/5561/5576

Downside Levels: 5471/5435/5423/5381

That’s all we got!

Like this post, share it with a friend.

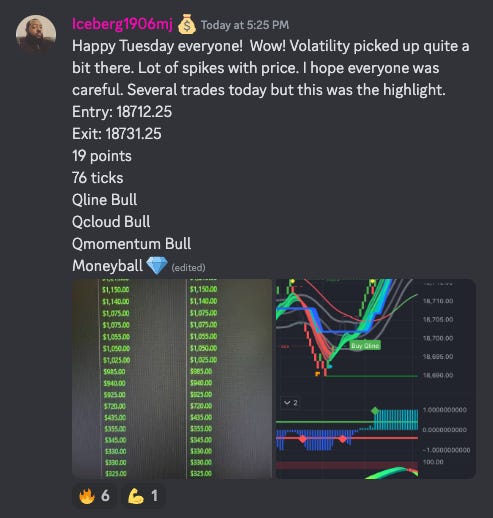

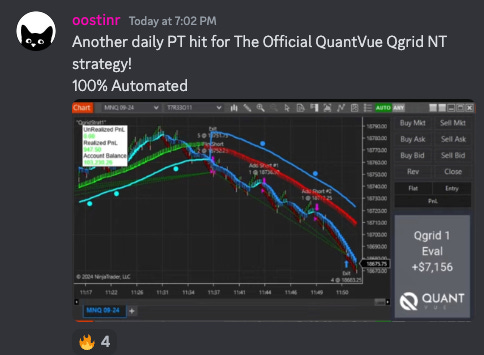

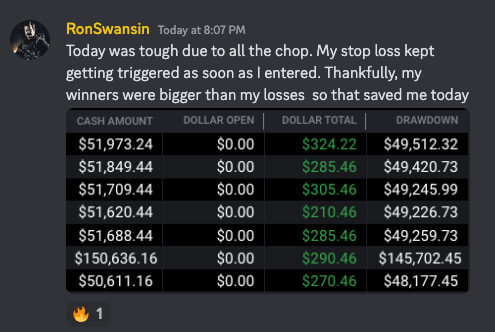

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.