Volatility Comeback

Hey team. As we approach mid week, a slew of economical numbers and speeches will bring the volatility back and shape another emotional environment.

Let’s recap today’s session and see what’s next for the markets!

Impact Snapshot Tomorrow

FOMC Meeting Minutes

Payrolls Revision

Market Evaluation

All three major U.S. stock indexes dipped, closing a multi-session rally that had seen the equities market rebound from a sharp sell-off triggered by recession concerns.

The eight days of consecutive daily gains were the longest winning streaks for the S&P 500 and the Nasdaq since November and December.

The recent rally was fuelled by bets the Federal Reserve will signal it’s getting closer to cutting rates.

The countdown to Jerome Powell’s speech Friday in Jackson Hole and Wednesday’s US payrolls revisions are poised to capture Wall Street’s attention.

Market participants will closely analyse Powell's speech for clues about the timing and number of anticipated policy rate cuts this year and next.

Markets Breakdown

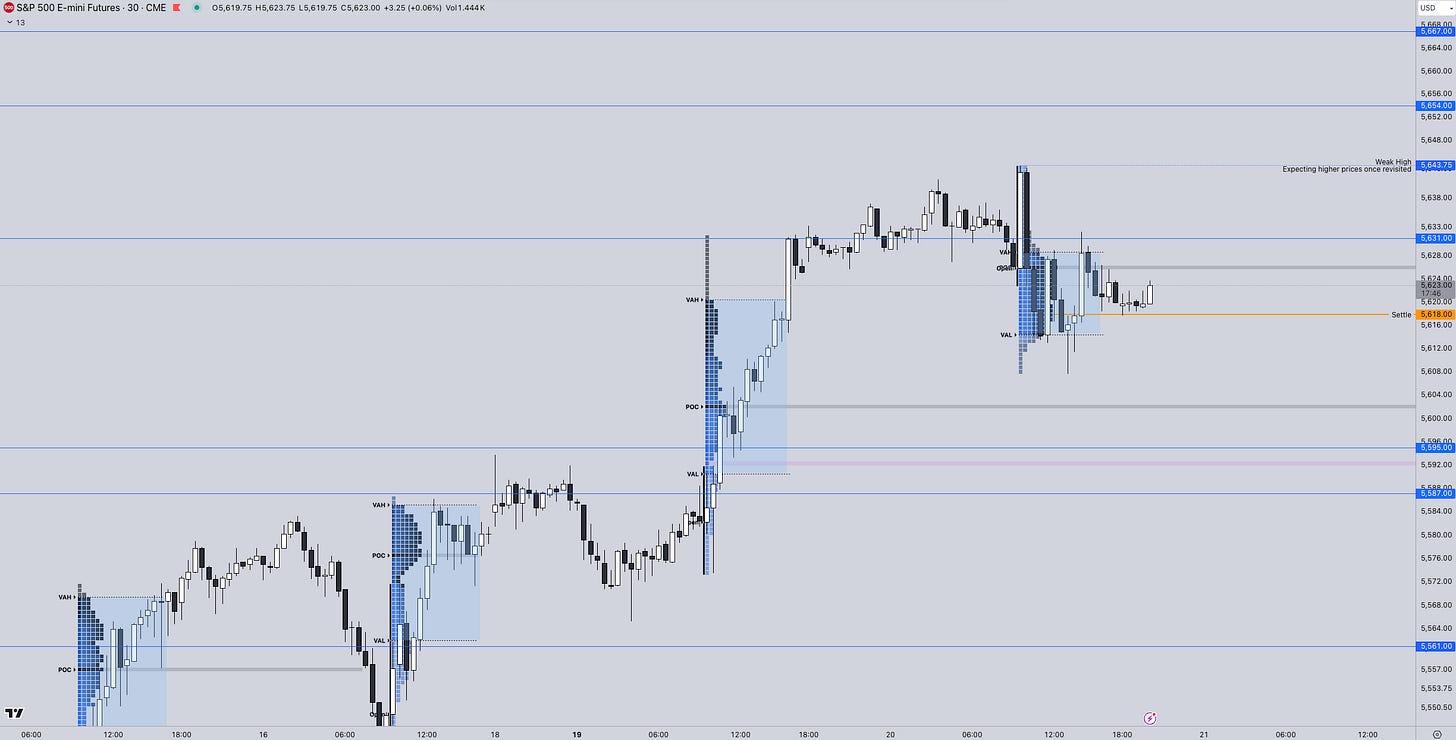

When the price is moving in a directional way and you have references and potential s/r pivots, you want to see if lower/higher prices are joined by higher volume on the way of that directional move or not.

A great example was in today’s session with the 5611 level we’ve shared this morning in our market brief over on X (read it here).

There is a big difference between “break and hold” below a reference, which is an indication that lower prices are attracting more selling in comparison to a look below and fail to get any continuation and immediately retrace back up.

Right after the wick below 5611, we bounced again on the same reference on a 20 points move towards the settle. (Read update here).

As the market moved lower below support, it did so with lower volume. Now everyone that was shorting below support on low volume is what you call “trapped sellers”.

Market get’s a counter reaction not exclusively because buyers stepped in to buy the market but these trapped sellers have to close their positions and provide additional fuel to the move up. How do you close a short? You have buy.

This is why we often say that sometimes, it’s better being a little bit late to a move than being too early.

ES

Some references we’ll be looking going forward:

Upside Levels: 5631/5654/5667

Downside Levels: 5595/5587/5561

That’s all we got!

Like this post, share it with a friend.

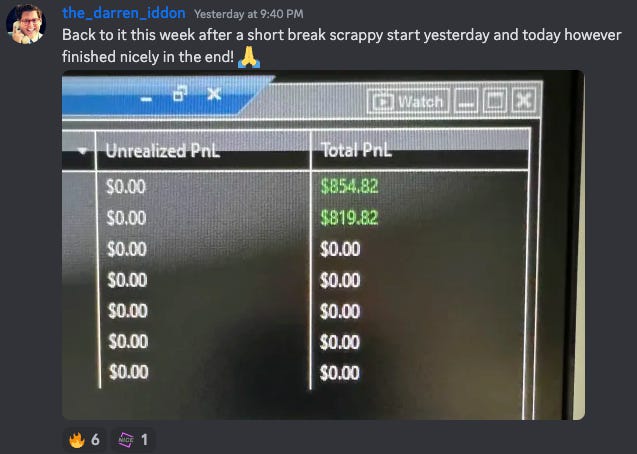

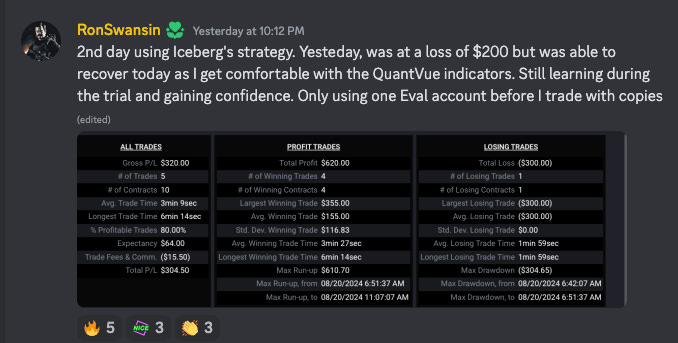

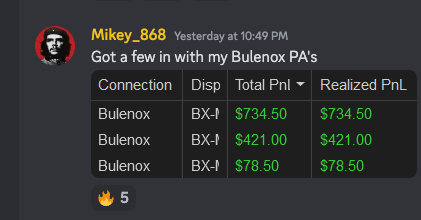

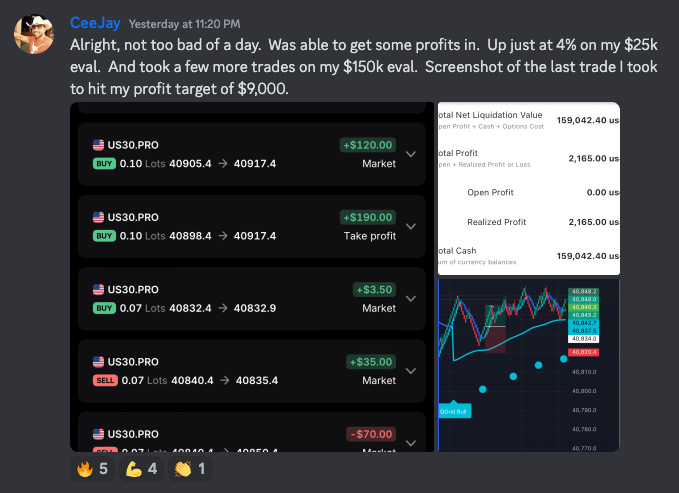

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.