Volatility Looms

Traders are preparing for a return of volatility ahead of upcoming jobs data, the Federal Reserve meeting, and the quarterly triple-witching options expiry.

Impact Snapshot

Retail Sales - Tuesday

FOMC Rate decision - Wednesday

Unemployment Claims - Thursday

Triple-witching expiration - Friday

Macro Viewpoint

US stocks were little changed Friday, though the S&P 500 gained +1.6% last week as macro data (inflation, labor, and consumer sentiment) continue to provide room for the Fed to restart its rate-cutting cycle.

Consecutive cuts are now the baseline, and vol melted lower, especially in the front end of the curve.

Instead of finding ways to rationalize a pullback, markets got a double-dovish data point = More Fed, as the market shifted to nearly a full embrace of 3 cuts by YE, which saw stocks squeezing higher after the big Thursday data.

We shared with you last Wednesday some of the data points that helped us hold a bullish bias last week, along with our expectations for CPI on Thursday that were seeing outcomes being skewed positively.

Guess what happened after the fact.

Prime Intelligence

US equities saw little net activity on the week, as HFs net sold Fri–Tues but turned buyers Wed/Thurs into and post the CPI print.

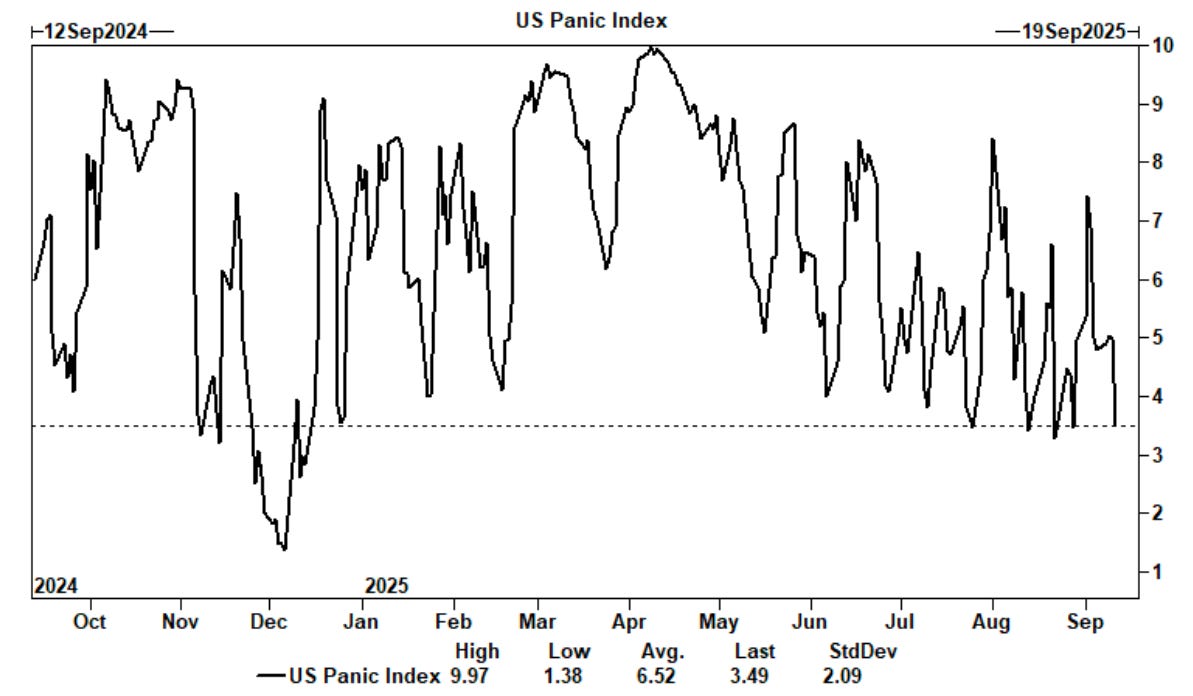

As the market continues to break to new highs, the VIX has returned to a 14-handle, and the Vol Panic Index retreated to YTD lows.

We estimate dealers are an 8/10 in terms of gamma length in the S&P, which has helped suppress the market so far as we continue to see extremely low daily straddle prices and saw one of the tightest intraday bands YTD on last Monday.

In today’s Prime Intelligence, we share the latest positioning and flows intelligence right out of Wall Street’s biggest trading desks.

Is the market poised for continuation, or are we running out of steam?

Let’s find out 👇