Waiting Game

Hey team. We have a shortened week ahead with Monday being a holiday and Friday expected to bring a key catalyst.

Let’s recap last week and see what’s next for the markets!

Impact Snapshot

US stock market will be closed Monday for the Labor Day holiday

ISM Manufacturing PMI - Tuesday

JOLTS Job Openings - Wednesday

Unemployment Claims - Thursday

ADP Non-Farm Employment - Thursday

ISM Services PMI - Thursday

Non-Farm Employment Change - Friday

Unemployment Rate - Friday

Average Hourly Earnings - Friday

Market Evaluation

It began badly. But four weeks after the most severe bout of market volatility since the pandemic, August will be remembered as another bold display of Wall Street's confidence in its capacity to predict the future.

Up 25% in the past 12 months, the S&P 500 has never climbed this much in the run-up to the first interest-rate cut of an easing cycle.

The S&P500 index rose 0.2% this week and posted a 2.3% gain for the month, fueled by optimism that Federal Reserve officials might implement an interest rate cut in September.

Gains in recent weeks been spurred partly by speculation the Fed's policy-setting committee will begin cutting rates at the September meeting.

Fed Chair Jerome Powell said last week "the time has come" for rate cuts. This week's economic data appeared to bolster those prospects.

Consumer spending rose as expected in July, while the Fed's preferred inflation metric, personal consumption expenditures, unexpectedly held steady at the annual level.

Economic data in focus will be the August employment report due at the end of the week.

Markets Breakdown

There has been a significant accumulation of positions at the balance highs, so it will not be uncommon to see an attempt for a clear breakout from the range highs to the upside, building some excess early in the week to re-test the all-time highs.

A balance or range formation is the market’s way of communicating that it always requires further information before its next directional move.

The balance rules you want to note down are as follows:

Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

The shortened week will end with another key catalyst to watch: US unemployment claims are due on Friday.

While the Fed has found some success in battling inflation, a continuous uptick in the unemployment rate will almost always lead to a recession.

Keep that in mind regarding the longer-term outlook as we head into September.

ES

Some references we’ll be looking going forward:

Upside Levels: 5673/5685/5708

Downside Levels: 5644/5631/5587

That’s all we got!

Like this post, share it with a friend.

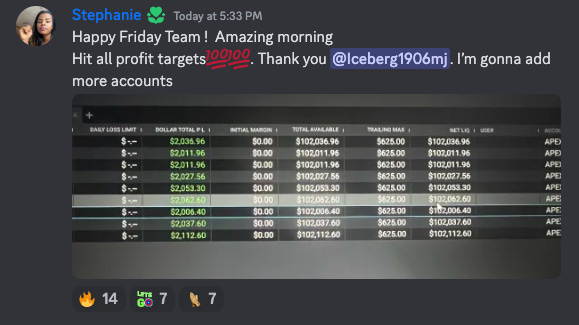

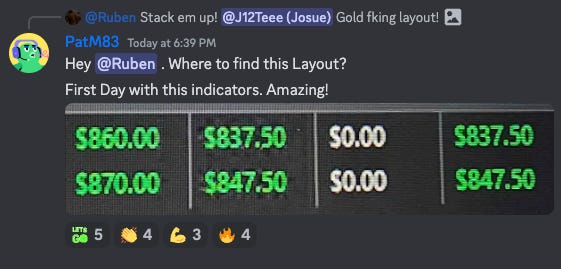

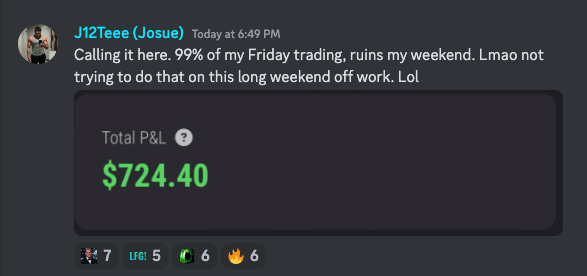

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.