Through The Noise

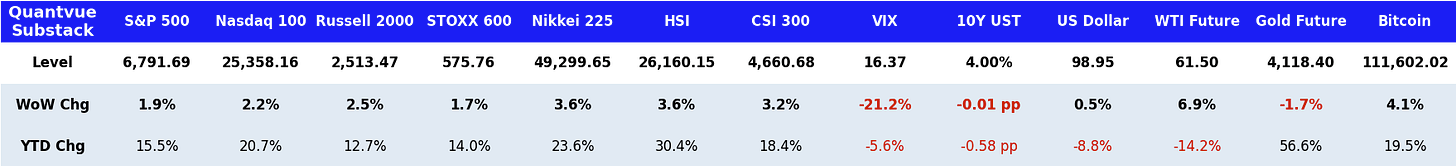

S&P closed last week +1.9% at new ATH thanks to a soft CPI, largely constructive earnings, and easing US-China tensions.

Impact Snapshot

Fed Interest Rate Decision - Wednesday

President Trump Meets President Xi - Thursday

Key Upcoming Earnings: MSFT 0.00%↑ GOOGL 0.00%↑ META 0.00%↑ AMZN 0.00%↑ AAPL 0.00%↑

Through The Noise

After the pullback of 10-Oct, there has been an environment of extreme fear in the market. Last week, and in two separate mentions on the FREE edition of the brief [Here] and [Here], we WARNED you that this “extreme fear” was NOT what the market does before a crash while being 1.5% away from an all-time high.

A few days after the fact, the market is at all-time highs. If you sold your portfolio after 10-Oct because some talking suit on a CNBC panel got “worried about tariffs,” or your next-door social media influencer posted a video with a big fat thumbnail saying “I SOLD,” reconsider your sources that affect your actions.

It’s incredible the amount of “noise” we see around the space of trading and investing, which directly affects the actions of many new participants.

What WE Saw Based On Data

Everything mentioned and written below was shared between the free and paid versions of the Market Brief, days & weeks before the ATH on Friday.

After the crash on 10-Oct, we reviewed the data and published our report on 12-Oct, highlighting that what took place during the pullback was a rush by institutional clients to HEDGE their long positions by buying downside protection through options and VIX, NOT selling or liquidating these positions.

This rush to buy downside protection triggered mechanical selling by systematic and volatility-controlled funds which were excessively sensitive to any significant move at that time. These types of funds often use a volatility-adjusted, trend-following strategy to allocate capital in futures markets.

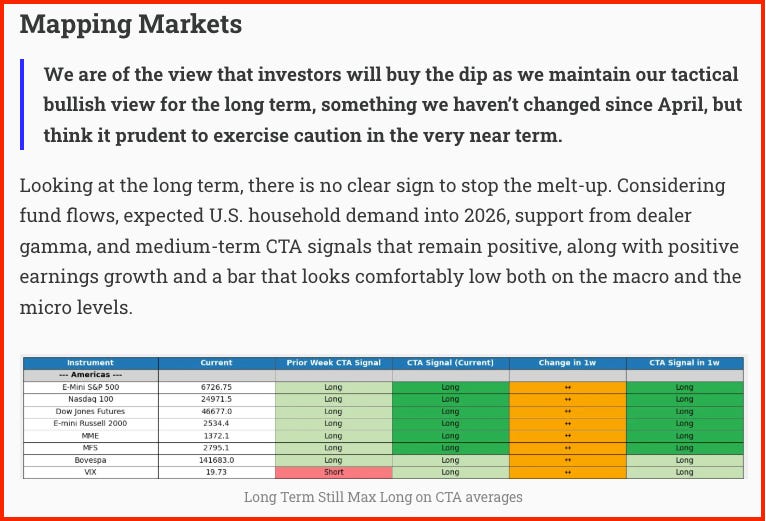

On Oct-15, after a careful evaluation across multiple data variables, we updated our thesis exclusively for our Subscribers, highlighting that this was going to be a dip-buying opportunity and that we were maintaining our bullish view.

On Oct 23, we reiterated this view, continuing to express our confidence that the market has NOT seen the all-time high for the year.

A day later, we’re back at the all-time highs.

Confidence stems from being data-dependent. We define long-term confidence as the ability to hold a bias without changing it every other session due to emotions, and we define data-dependent as the ability to evaluate market conditions based on quantified data.

If you want access to our daily market insights and opinions that are data-dependent, consider becoming a paid subscriber. 👇