Earnings Underwhelm

Hey team.

We've got another market brief on $ES for you discussing all the key things we’ll be looking moving forward.

Let’s jump in!

Impact Snapshot

Services / Manufacturing PMI - Wednesday

Key Earnings: IBM 0.00%↑ TMO 0.00%↑ T 0.00%↑

Market Evaluation

Wall Street's main indexes closed slightly lower on Tuesday, surrendering modest intraday gains in the final minutes of trading.

This shift occurred as investors turned their attention to the latest earnings reports from TSLA 0.00%↑ & GOOGL 0.00%↑ .

The start of the “Magnificent Seven” earnings season failed to impress investors after a powerful rally that drove the US stock market to a record-breaking run.

After leading the rally in US stocks for much of the year, big tech hit a snag last week.

Investors shifted away from high-flying megacap stocks to riskier, underperforming sectors of the market.

This rotation was driven by expectations of Federal Reserve rate cuts, the looming threat of additional trade restrictions on chipmakers, and growing concerns that the enthusiasm surrounding artificial intelligence might be exaggerated.

Markets Breakdown

Last Sunday’s substack highlighted that the market fell back into a prior balance range. Since Monday we’ve seen market building value to the upside.

On our market plan today posted here, we’ve highlighted the importance of reclaiming the 5625 as support in order to trigger continuation.

After a tick-perfect rejection, the market saw a pullback towards the settle with another attempt to reclaim that area that failed. Read the update here.

Consolidating and “coiling” on exact references in the market can provide weakness in these areas.

When the market is too short or too long on an exact pivot, the odds of it lasting are low.

This is where we posted another live update couple of hours before the US close, signalling that the market had a lot more room to break to the downside, below the “weak” area of 5604. Read it here.

The emotional reaction off of the earnings doesn’t change the fact that the market has continued building value to the upside which will be the main focus tomorrow for another attempt of acceptance back inside 5600s or the lack of.

ES

Some references we’ll be looking going forward:

Upside Levels: 5616/5643/5667

Downside Levels: 5561/5534/5519

That’s all we got!

Like this post, share it with a friend.

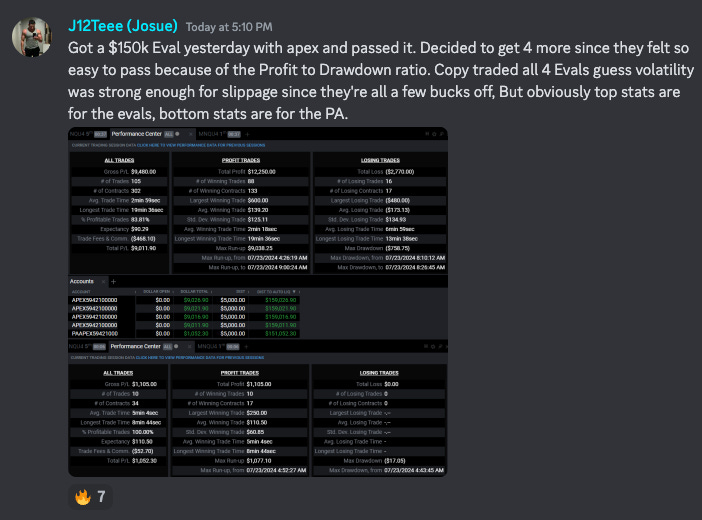

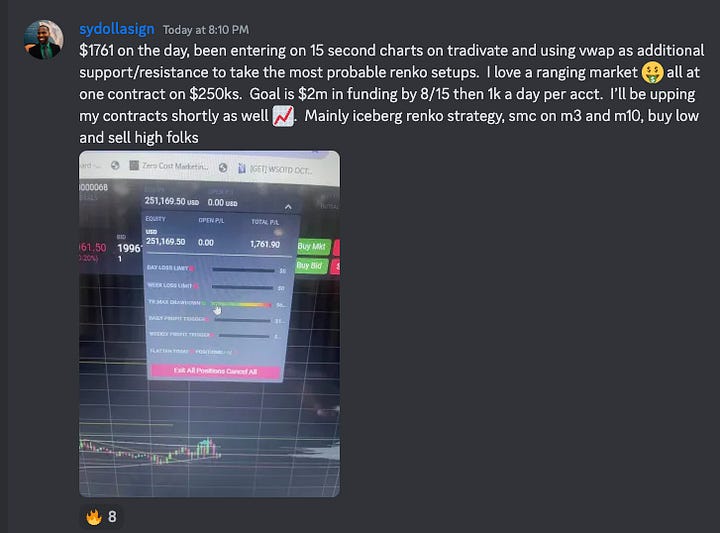

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.