How we're trading next week

Hey team.

The lack of key economic releases and holiday session on Wednesday is likely to see a less volatile market in contrast to last week.

Let’s re-cap last week’s events and see what’s next for the market!

Impact Snapshot

Retail Sales - Tuesday

Bank Holiday - Wednesday

Unemployment Claims - Thursday

Flash Manufacturing /Services PMI - Friday

Market Evaluation

The S&P500 index climbed 1.6% this week, achieving new highs. The Nasdaq edged higher, marking a record close for the fifth consecutive session.

Strength in the tech sector fueled this week's market climb, despite the FOMC reducing its projected number of rate cuts for 2024 to just one.

The central bank’s projections for fewer rate cuts this year and Fed Chair Jerome Powell’s seemingly hawkish comments at his press conference on Wednesday didn’t prevent the market from reached new all time highs.

Investors are being warned that interest rates will stay higher for longer than they’d expected. Yet cash is pouring into stocks that benefit from lower borrowing costs

Markets Breakdown

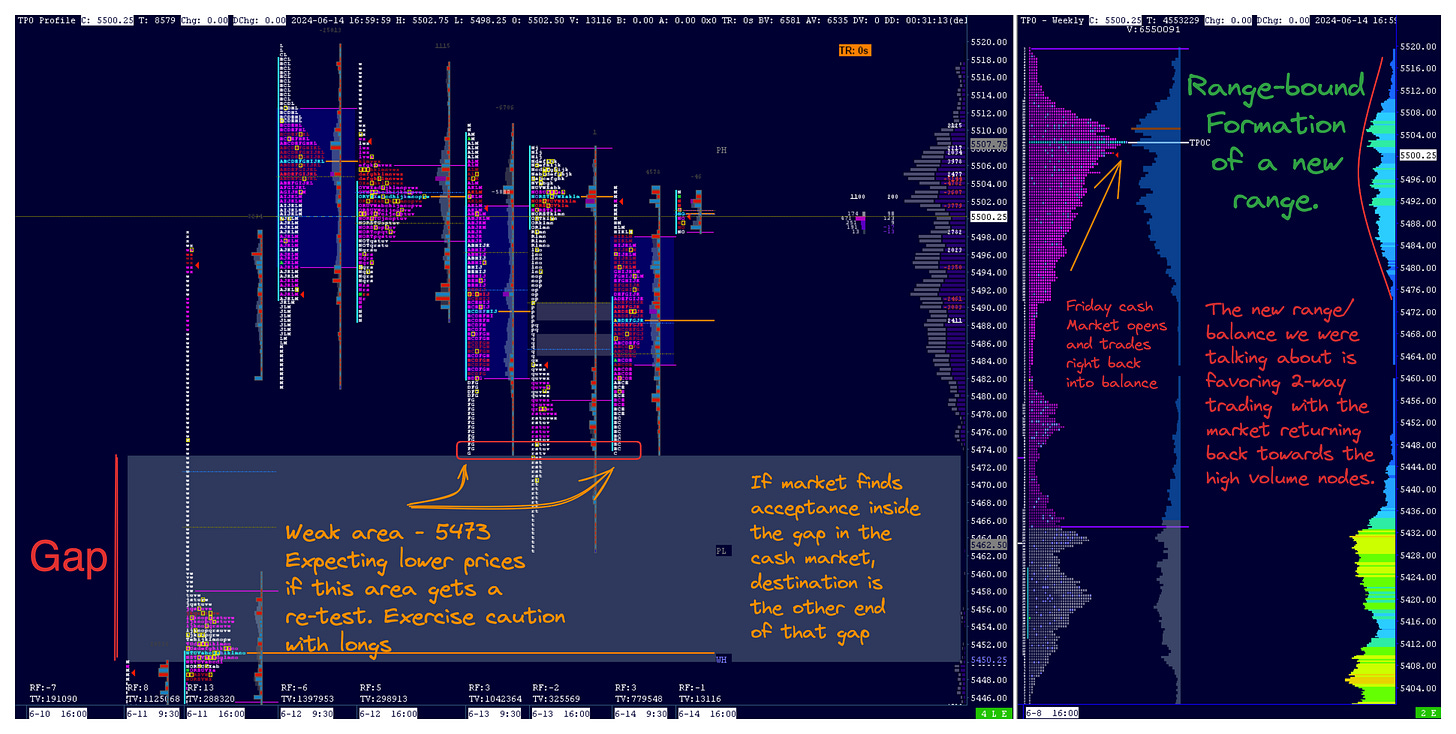

On our last newsletter we highlighted that the market was looking to establish a range-bound environment after the emotional economical releases.

Friday’s market report was looking for a correction to close the gap opened on an attempt to break from the 2-day balance establishment in the overnight session.

If a breakout from balance fails, you wanna go against it with the potential of the market trading towards the other end of that balance/range.

Sellers failed to establish any acceptance below 5400s and were trapped shorting support, leading to a complete rollover towards the other end of balance.

Read the post and live updates we’ve made here.

Heading into the next week, the lack of major economical releases will likely see a market with less initial volatility.

Further establishment inside the 3-day balance range is a sign of market accepting higher prices and maintaining activity above the gap left on 6/11 keeps the uptrend intact and is a signal of strength for new all time highs ahead.

On a potential re-test of the “double bottom” at 5473, we’ll exercise caution with longs as the odds of a break below of at least couple ticks of excess are high.

ES

Note: We’ve switched to the ESU4 contract

Some references we’ll be looking to start the week:

Upside Levels: 5512/5549/5566

Downside Levels: 5494/5481/5450

That’s all we got!

Like this post, share it with a friend.

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.