Identifying Change

Hey team. After a historical day that shook the markets across the globe, we’ve seen some recovery to close Tuesday on the positive side. Let’s re-cap today’s session and see what’s next for the markets!

Market Evaluation

The S&P500 and Nasdaq ended 1% higher on Tuesday as investors returned to the market following an emotional sell-off. Recent comments from Federal Reserve officials helped alleviate concerns about a U.S. recession.

A renewed wave of dip buying spurred a rebound in stocks after a roughly $6.5 trillion selloff that shook markets around the globe.

VIX, a gauge of stock market volatility, skyrocketed by more than 100% at one point yesterday to hit a four-year high above 60 while today, it saw its biggest plunge since 2010.

U.S. central bank policymakers have dismissed concerns that weaker-than-expected July jobs data indicates an impending recession.

However, they have cautioned that the Federal Reserve will need to lower interest rates to prevent this scenario.

Markets Breakdown

Change in the market is the most significant nuance to pay attention to. One of the identifications of market change are gaps. Usually, the bigger the gap, the harder it is to get filled on the upcoming US session.

“Black Monday” was one of these unique sessions that we’ve been talking about on a recent newsletter, a report with the name “A change in tone”.

In the notes of this post, we’ve shared the importance of identifying momentum and to exercise caution when you see lower prices bringing in more volume.

Despite the fact that this has been one of the-most volatile session in recent times, it still fell under our bearish scenario posted pre-market over on X with an update here.

Today’s session fell under the “balance” and range formation comments we’ve shared as bulls successfully managed to build value to the upside after 3 days of continues selloff.

Our bullish scenario was seeing a flip of 5289 would trigger continuation towards 5320/5341 which ended up being the absolute top of the session and later saw a 100 points rejection off of. Read update here.

Despite these being some of the most harsh market conditions to trade as high volatility equals high risk, we can still identify and trade areas if we have a framework of potential outcomes to look for.

ES

Some references we’ll be looking going forward:

Upside Levels: 5314/5361/5387

Downside Levels: 5205/5187/5158

That’s all we got!

Like this post, share it with a friend.

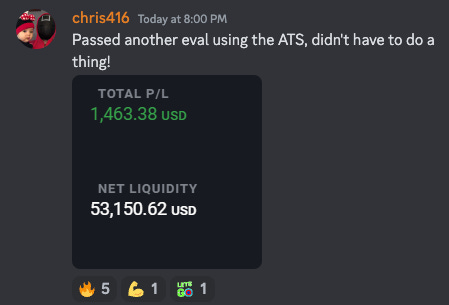

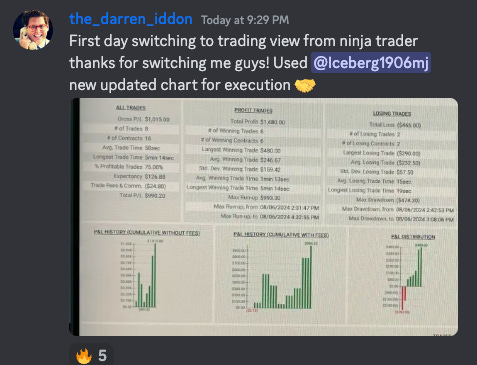

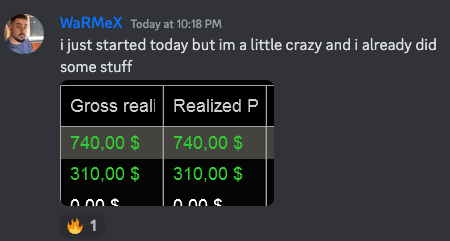

Oh… here’s some incredible QuantVue Pro Member results from this week:

Watch our latest YouTube Video Here:

QuantVue ATS - Prop Automation Program

AUGUST ATS AVAILABILITY UPDATE: 9 spots left

Join 125+ clients automating their futures prop firm trading with the QuantVue ATS (Automated Trading Suite).

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.