Market action discounts everything

Hey team.

We’re back with another market report where we share insights of what we were looking prior to the US open today and how it unfolded.

Let’s jump in!

Market Evaluation

Wall Street's primary stock indexes ended Tuesday on a positive note, driven by advances in megacap growth stocks.

Trading volumes were light ahead of the July Fourth holiday and the highly anticipated release of June nonfarm payrolls on Friday.

The U.S. job openings and labor turnover survey (JOLTS) revealed that job openings rose in May following significant declines in the previous two months. However, layoffs also increased due to slowing economic activity.

Friday's release of June nonfarm payrolls will be crucial in assessing whether the U.S. labor market remains resilient against the backdrop of decades-high interest rates.

Markets Breakdown

You’ll probably hear a lot different opinions as to why the market pumped 30 points right at the open.“Powell said this so we pumped” or a classic“My RSI said oversold so we pumped”.Those could be some common answers you’ll hear among different traders.

The truth is that most retail traders don’t understand why the markets they trade are actually moving.

On our Sunday Substack posted here we shared the balance guidelines. Today was yet another look bellow/above balance and fail session with the market bouncing off of the key support at 5503 and market making a full correction and re-test of the balance high.

If you follow us for a while, you’ve heard these exact terms about gap corrections “overnight gap fills” etc. When the overnight is too short or too long, a correction is favourable at the open.

If you align these data points on top of the key support at 5503 and balance guidelines (look above/below and fail, destination trade the other end of balance), you have “increased the odds” of a correction being underway and if you’re a trader, you better believe you want the odds in your favour. Read update posted here.

ES

Some targets we’ll be looking moving forward:

Upside Levels: 5578/5603/5616

Downside Levels: 5548/5535/5520

That’s all we got!

Like this post, share it with a friend.

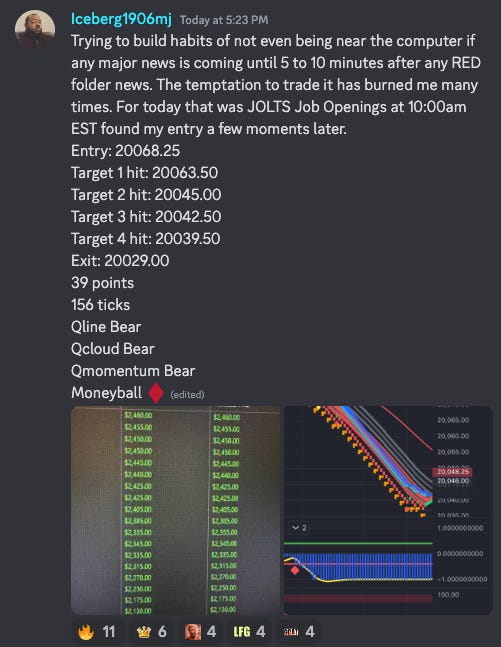

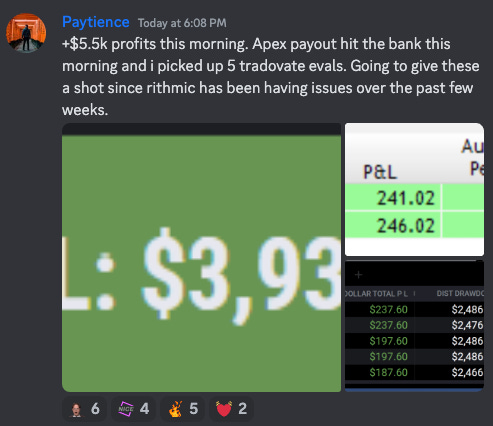

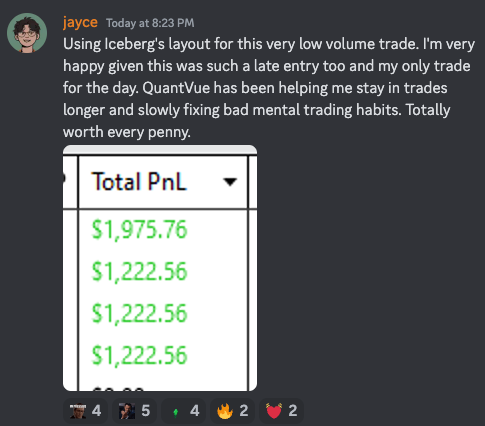

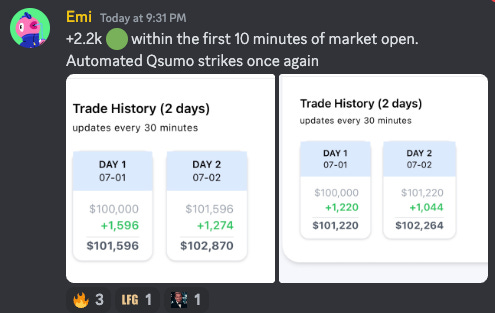

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.