Patterns of Emotion

Hi Team. The S&P 500 hit one record high after another this year and is heading to a 25% gain in 2024, marking the strongest consecutive annual performance since the late 1990s dot-com era.

Let’s review last week’s highlights and discuss what’s ahead as we head into the final week of the year!

Impact Snapshot

New Year’s Holiday - Wednesday

Unemployment Claims - Thursday

ISM Manufacturing PMI - Friday

Macro Viewpoint

The S&P 500 managed to sidestep a third consecutive weekly decline, gaining 0.7% and boosting its year-to-date increase to 25% with just two trading sessions left in 2024.

Friday saw a pullback in stocks due to profit-taking and uncertainty over how markets might perform in January.

Holiday retail sales exceeded expectations, outpacing last year’s growth rate and highlighting consumer resilience.

Investors will gain new insights into the U.S. economy's health when the monthly employment report is released on Jan. 10.

The market’s momentum will face further scrutiny as U.S. companies begin reporting fourth-quarter earnings shortly thereafter.

Next week's economic calendar will feature the Institute for Supply Management and S&P Global's US manufacturing sector data for December. Markets will be closed Wednesday for New Year's Day.

Emotion-Driven Trades

The following article highlights how correlated markets are to human emotions and how this is communicated through the charts.

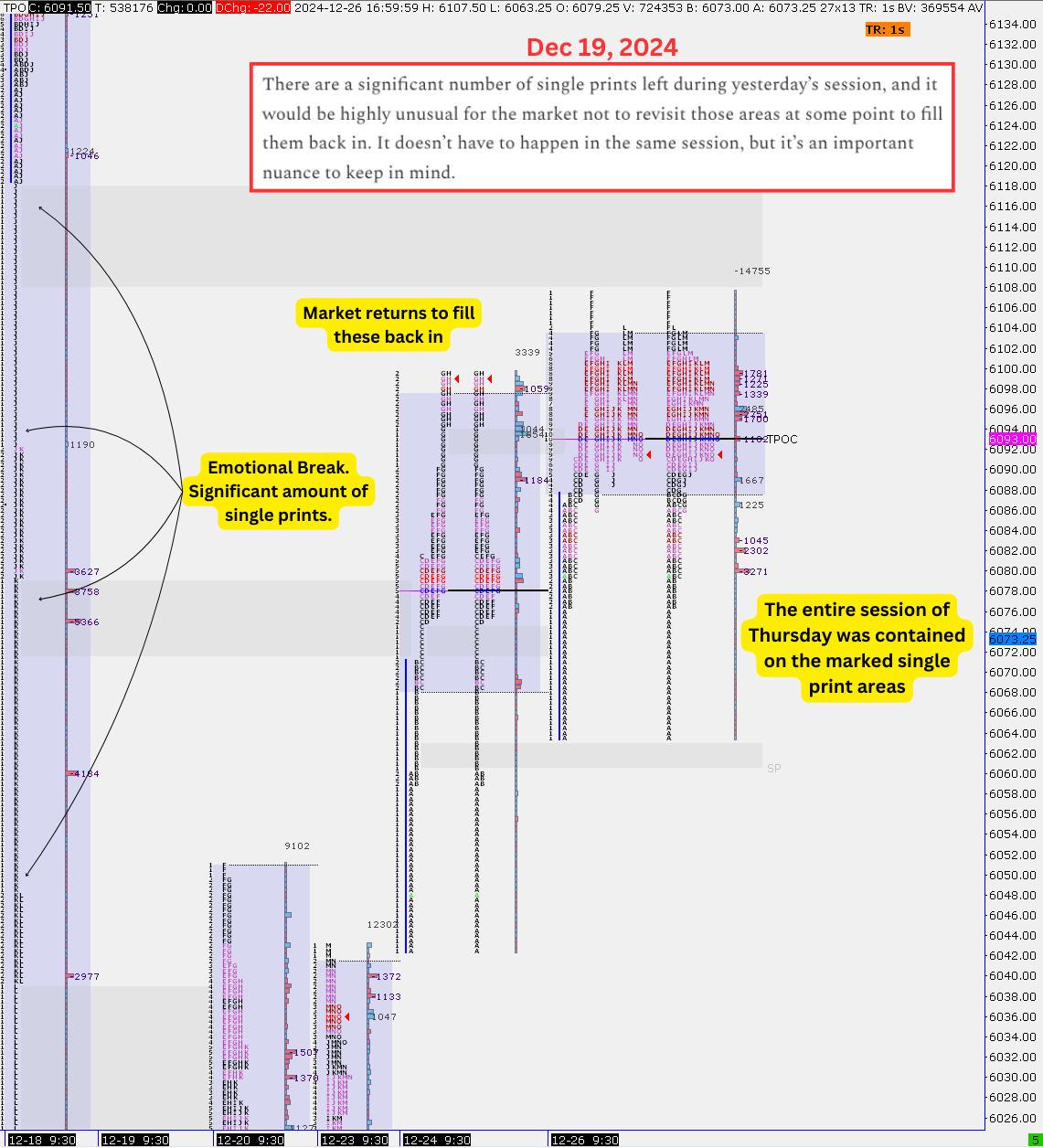

When the market breaks away, it will leave a series of single prints. That’s when a single letter is printed on a market profile. (Unfilled single print areas are in gray.)

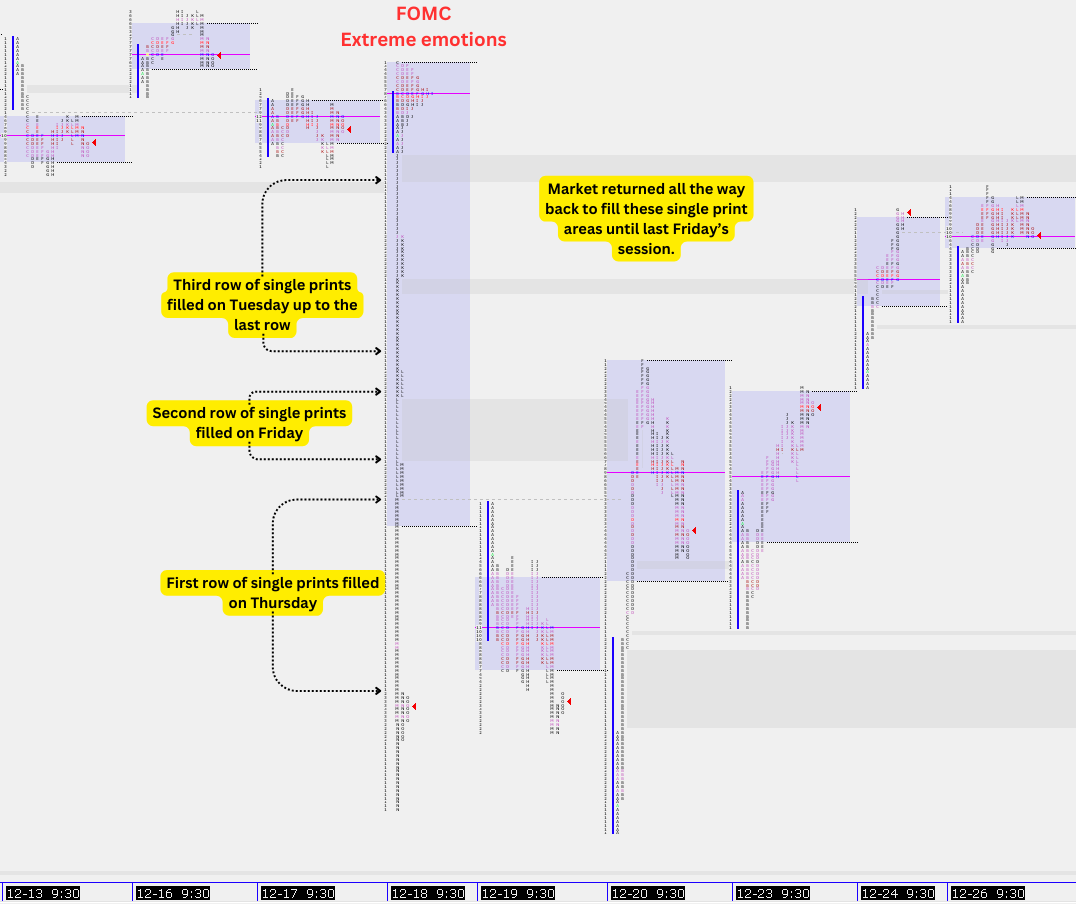

During our market report on the 19th, right after the extreme emotional FOMC break, we highlighted— as shown in the attached picture above— that it would be highly unusual for the market not to return and fill those areas in.

For the next five trading sessions, the market did nothing but follow the exact quote we shared, with buyers finding a massive opportunity to retrace the entire move—over 200 points— all the way back to fill those single prints.

A trader who is confident that the market is under- or overvalued is more likely to take a position and hold it than a trader who is uncertain about value.

A significant number of single prints indicates an emotional market and uncertainty. Markets truly communicate human emotions. Since markets are comprised of people, it stands to reason that they reflect human behaviour patterns.

Think about it—when we are emotionally affected, we don’t quite make our best decisions, right?