The Market Brief

Hey team, U.S. stock index futures advanced during the overnight as investors evaluated the Federal Reserve's forecasts, which signaled fewer-than-anticipated interest rate cuts and elevated inflation expectations for the coming year.

Let’s re-cap yesterday’s session and see what’s next!

Impact Snapshot

🟥 Unemployment Claims - 8:30am

🟥 Q3 GDP - 8:30am

Fed reduces rates by 0.25%, projects two cuts in 2025

Powell expresses confidence in continued inflation decline

Macro Viewpoint

US stocks are poised for a partial rebound on Thursday, hinting that the sharp decline following the Federal Reserve's hawkish shift may have been an overreaction.

The Fed revised its 2025 outlook, reducing the projected number of rate cuts to two, as Chair Jerome Powell emphasised that further easing would depend on continued progress in curbing inflation.

This adjustment disrupted the impressive rally in US equities this year. However, the S&P 500 remains on track for gains exceeding 20%, driven by enthusiasm surrounding artificial intelligence and positive sentiment about the economy under a Donald Trump administration.

Although the intensity of Wednesday’s selloff highlighted that equity markets were caught off guard by the Fed’s update, the change suggests the potential for stronger-than-expected corporate profits in the near term.

Meanwhile, money markets are now anticipating fewer than two quarter-point rate cuts throughout 2025, even lower than the projections outlined in the Fed’s dot plot on Wednesday.

Prior Session Deep Dive

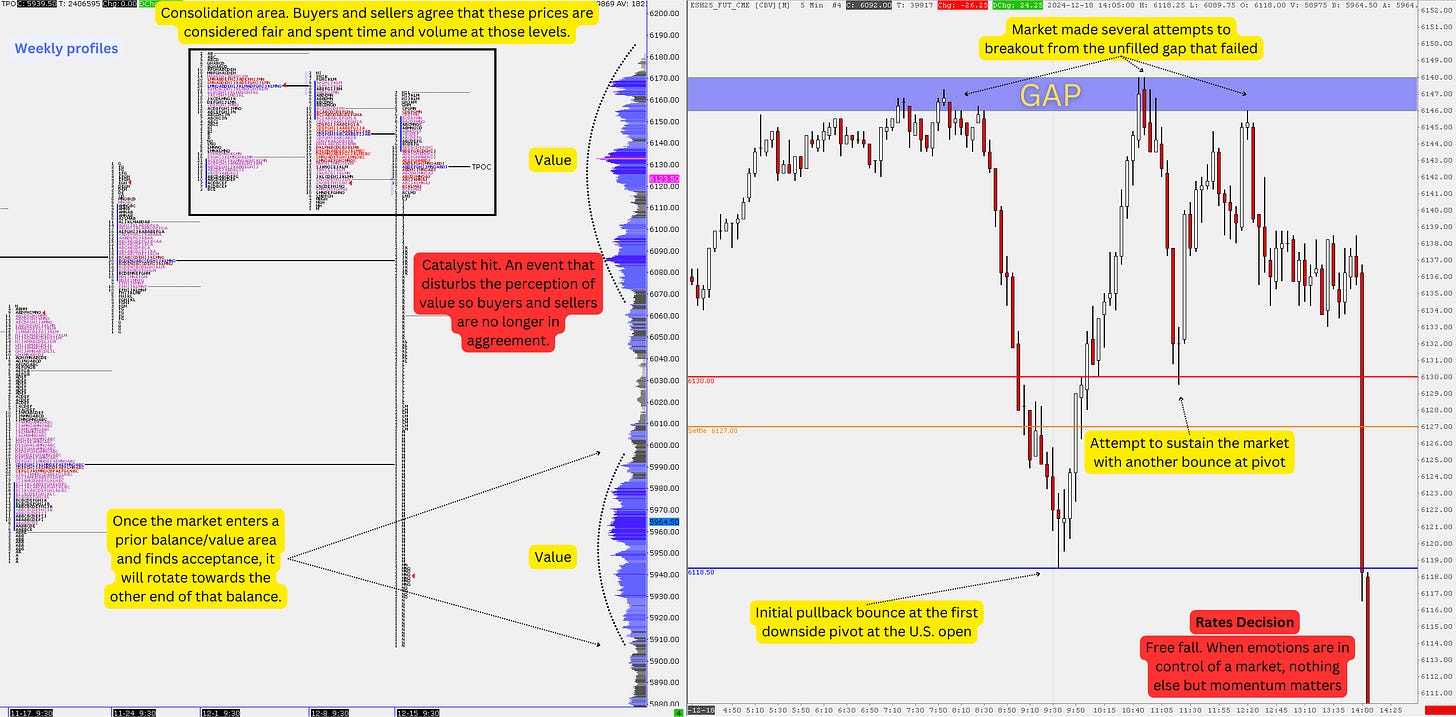

Today’s deep dive into the prior session begins with a snapshot of the exact outlook we shared in yesterday’s market brief, as it truly highlighted the importance of how events unfolded right afterward.

The initial session began like any other day, with the market continuing to coil within the balance range and making several attempts to reach the unfilled gap we had marked on the chart.

After initially rejecting that gap zone, the market bounced off the first downside pivot at 6118 and rotated back toward the same area, repeatedly attempting to fill the gap while moving back and forth around our pivot levels.

As we highlighted in the market outlook, the session was expected to shift significantly during the PM hours, and riding the momentum was going to be your best friend, not go against it.

You wouldn’t want to stand in front of a door when everyone is trying to get out at the same time right?

We shared this article a month ago, and if you haven’t read it yet, we highly recommend taking a few minutes to go through it. It covers one of the most important concepts you’ll ever encounter in the market.

Value—and the perception of it—is the foundation upon which all market activity occurs. When you trade without an idea of value in the market, it is difficult to believe that the market’s activity is not arbitrary or random.

Take a moment to review the attached chart image, read the “Free Fall” article, and replace the event example with yesterday’s catalyst to see where the market has landed.

Your ability—or lack of it—to grasp the concept of price/value relationship will profoundly affect how you perceive the markets.