price blindness vs context

Hey team.

On Thursday’s Substack we’ve projected insights of what to look for. Let’s see how Friday’s session followed up and see whats next for this week!

Impact Snapshot

Jerome Powell Speech - Monday

Retail Sales - Tuesday

Unemployment Claims - Thursday

Key Earnings: GS 0.00%↑ BAC 0.00%↑ MS 0.00%↑ NFLX 0.00%↑ UNH 0.00%↑

Market Evaluation

The S&P 500 index climbed 0.9% this week, hovering near record highs, despite mixed signals from inflation data and bank earnings.

This week's inflation data revealed that U.S. consumer prices fell as predicted last month, while June's producer prices increased more than anticipated.

The June CPI reading showed that prices fell for the first time since 2020, dropping 0.1% from May.

On a core basis, prices may not have fallen, but they still grew more slowly than expected, marking the smallest uptick since August 2021.

These cooler-than-expected CPI numbers pushed the likelihood of a September rate cut higher, with markets now predicting an 84% chance.

Markets Breakdown

On our last Substack we’ve given insights of what our expectations were ahead of Thursday’s sell off.

It was probably one of the most nuanced reports we’ve published that made a clear distinguishing point between sell-off that is triggered by market participants getting off the market and participants rotating capital to manage risk on different sectors.

Although asset management and portfolio rebalancing are concepts that are targeted around investing, having a good understanding of why something happens and how to spot it is very crucial for day-traders.

Most people focus exclusively on price, missing out on context and get caught up. What followed up was a session that was fuelled by short covering all the way towards a new all time high.

Read this report below for clues we’ve shared 1 day before the fact and the warnings we’ve projected.👇

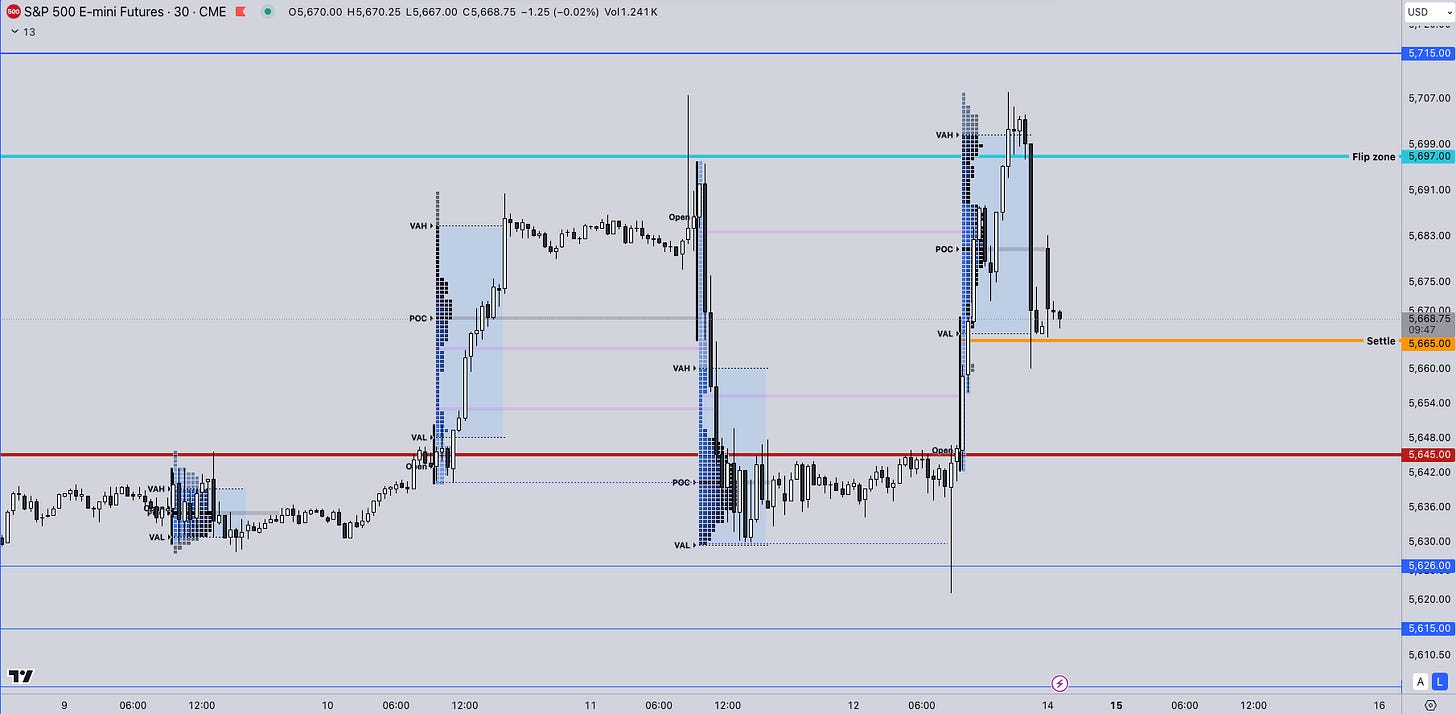

ES

With the market seeing another rejection off of 5700s our main focus will be rotational activity and overlapping value areas as the market will potentially seek to balance itself.

Some references we’ll be looking going forward:

Upside Levels: 5697/5715/5728

Downside Levels: 5645/5626/5615

That’s all we got!

Like this post, share it with a friend.

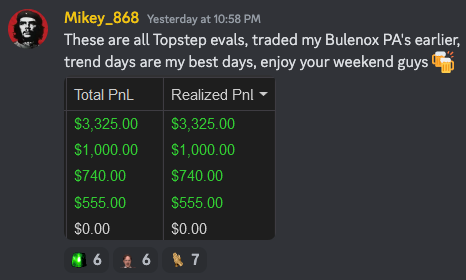

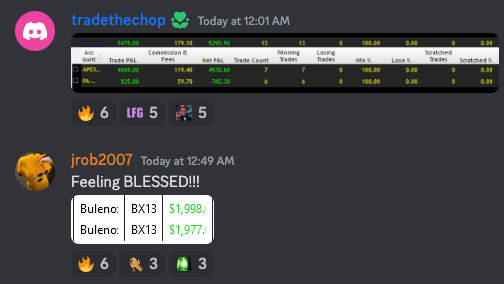

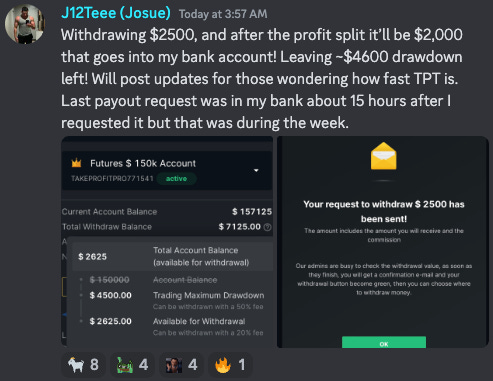

Oh… here’s some incredible QuantVue Pro Member results from this week:

We’ll see you again on the next one!

Want our premium TradingView & NinjaTrader tools?

Disclaimer: Futures and options trading carries a significant level of risk and may lead to substantial financial losses. The content provided in this newsletter is solely for informational purposes and should not be construed as a trade recommendation or financial advice. It is essential for readers to independently assess and make their own investment decisions, taking into consideration their personal financial situation and risk tolerance.