The Market Brief

U.S. futures are cautiously higher on Thursday as strong technology earnings shift focus away from the lingering threat of a U.S.-China trade war.

Macro Viewpoint

After months of relative calm, tensions between the U.S. and China have resurfaced, sending stocks on a rollercoaster as dip buyers step in following selloffs.

Investors, now accustomed to these tariff war threats, are increasingly recognizing that unless such developments actually hit corporate earnings, the true engine of market risk, they cannot significantly affect equity markets.

Several macro releases scheduled for today, including Retail Sales, PPI, and national Jobless Claims, will be delayed due to the government shutdown.

Prime Intelligence

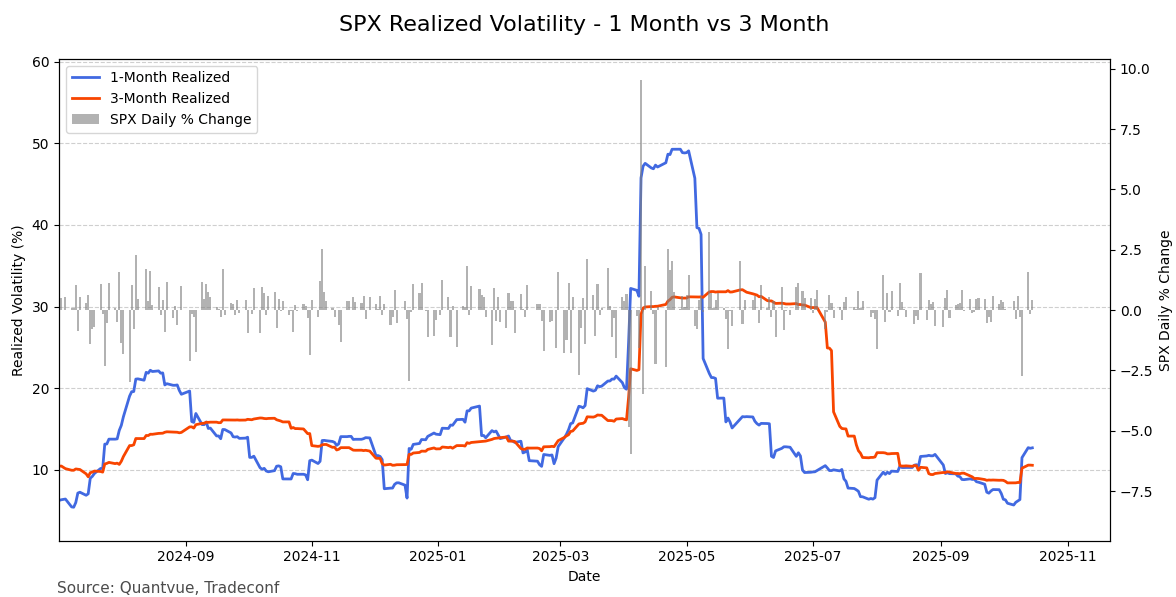

As we noted leading up to Friday, the market was extremely vulnerable to a spike in volatility, and mechanical selling would kick in with any upcoming catalyst.

Upside volatility is still volatility, and it can be just as destabilizing for strategies that rebalance mechanically based on risk. We’re currently monitoring whether this event was episodic rather than a trending increase in volatility.

As we forecasted in our Sunday newsletter, this was an attempt to hedge large long positions, and the selling was simply mechanical and tied to the spike in volatility. Everyone who held shorts over the weekend found out the hard way how significant understanding this nuance truly was.

This influenced our broader risk perception. Instead of attributing market moves to headlines, we rely on quantified data, which you can access below. 👇