The Market Brief

U.S. futures edged higher during early trading after a rebound in tech, driven by upbeat earnings and optimism that the U.S. government shutdown is nearing an end, which has lifted sentiment.

Macro Viewpoint

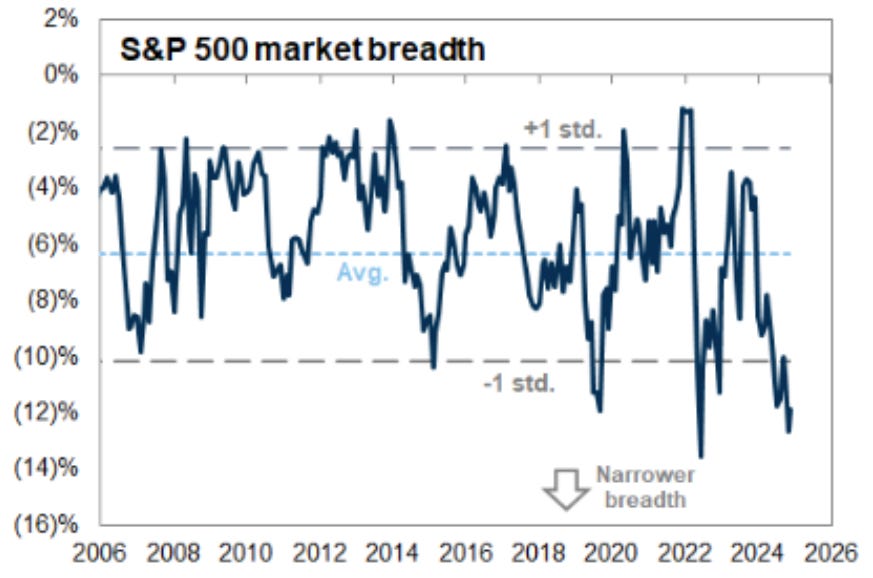

Breadth has slightly improved since last week and has changed gradually in either direction, which, in our view, supports the case for strategic rotations rather than a structural market sell-off.

We’ve WARNED about this since last Friday, that this was a market experiencing capital rotation across sectors and was still RISK-ON..

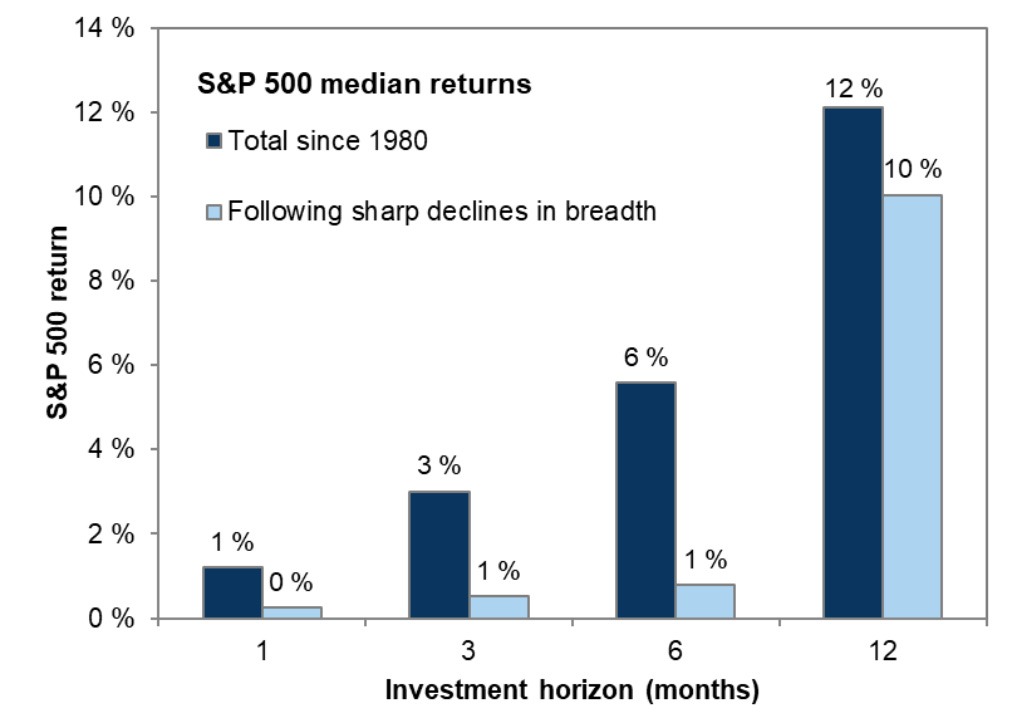

While narrow breadth has been cited as a cause for concern, we find that the median returns looking back to 1980 for the S&P following sharp declines in breadth is flat over 1m but up + 1% by 3m and + 10% over 12m.

All the “valuation doomers” trying to call a top will be faced with what the market does when everyone expects the same thing, as evidenced by the extreme fear 1% away from all-time highs.

“Markets can remain irrational longer than you can remain solvent.”

Prime Intelligence

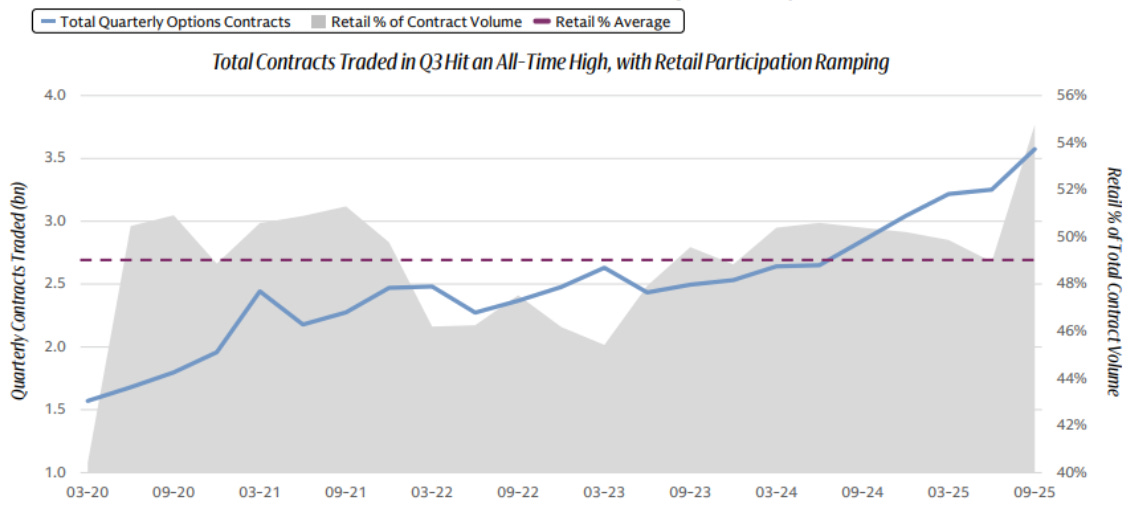

So far, there is substantial evidence that higher-volatility stocks are being heavily impacted by options market activity.

Among high-volatility stocks, those with the lowest share prices and the most short interest have rallied the most, raising suspicion that hyperactive retail traders could be behind the move, similar to the behavior seen during the “meme stock” frenzy of 2021.

Contract volumes have set new records, with retail participation being a key driver. For the first time on record, the U.S.-listed options market traded over 3.5 billion contracts in a single quarter. Q3 2025 contract volumes were up +10% QoQ and +26% YoY.

Retail participation as a % of total contract volume reached 54% in Q3 2025, an all-time high

Since 2020, we estimate retail volume to have averaged 49% of contract volume

Lowest retail level participation observed was in Q1 2023 at 45% of contract volume

Retail volumes are heavily concentrated amongst brokers, with the top two commanding 60% of Q3 activity, and the top five holding 85% market share.

This is a FREE edition of the Market Brief. To receive our additional quantitative research, consider becoming a paid subscriber.👇