The Market Brief

U.S. markets surged during early trading on Monday, with S&P 500 futures bouncing 1.3% after the benchmark suffered its biggest drop since April.

Macro Viewpoint

Risky assets bounced back after the Trump administration toned down its comments toward China, easing worries that followed threats of an extra 100% tariff on Chinese goods in response to new export limits.

We think these moves are likely aimed at gaining some leverage ahead of upcoming talks between the two countries.

Big market selloffs have been rare recently, with the S&P 500 holding up thanks to optimism around artificial intelligence and hopes for U.S. interest rate cuts.

Prime Intelligence

Yesterday we talked about mechanical selling triggered by systematic strategies tied to volatility. These types of funds often use a volatility-adjusted, trend-following strategy to allocate capital in futures markets.

At the same time, institutional client flows showed significant demand for protection in the 1w–2m space as skew steepened drastically.

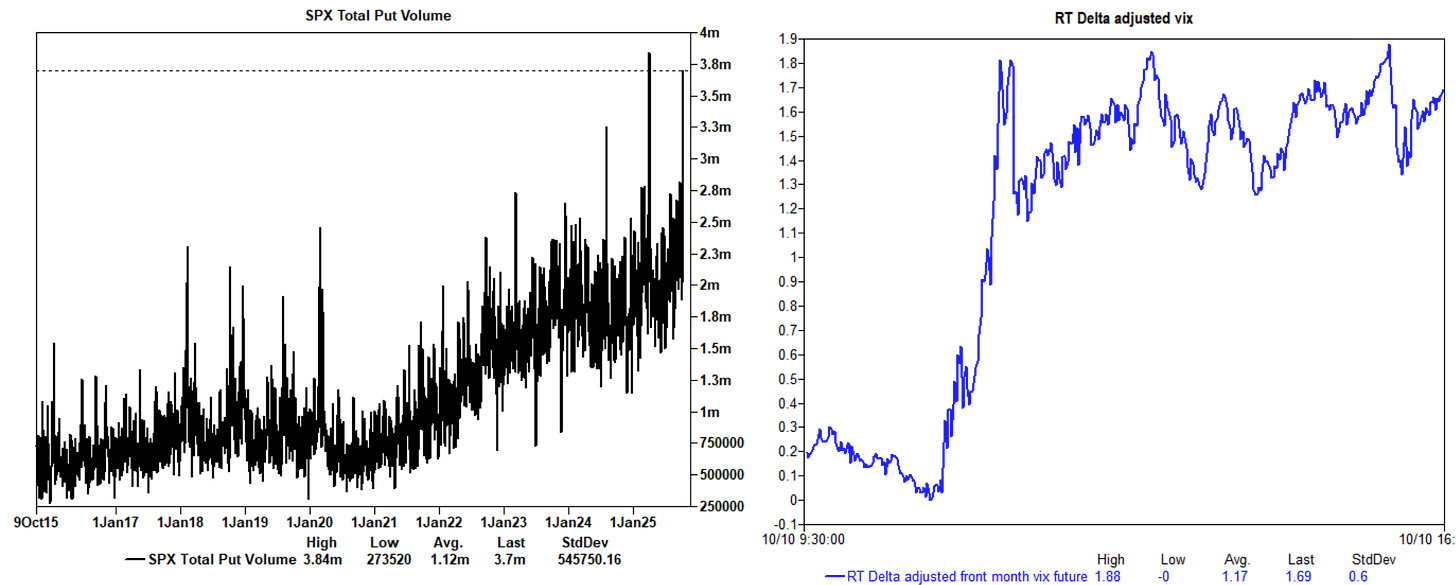

What do they do? They hedge with SPX puts and the VIX, the literal trigger of systematic volatility-targeting funds. We also saw them rolling puts down and monetizing VIX call spreads.

To contextualize this, Friday saw the second-highest SPX put volume of all time.

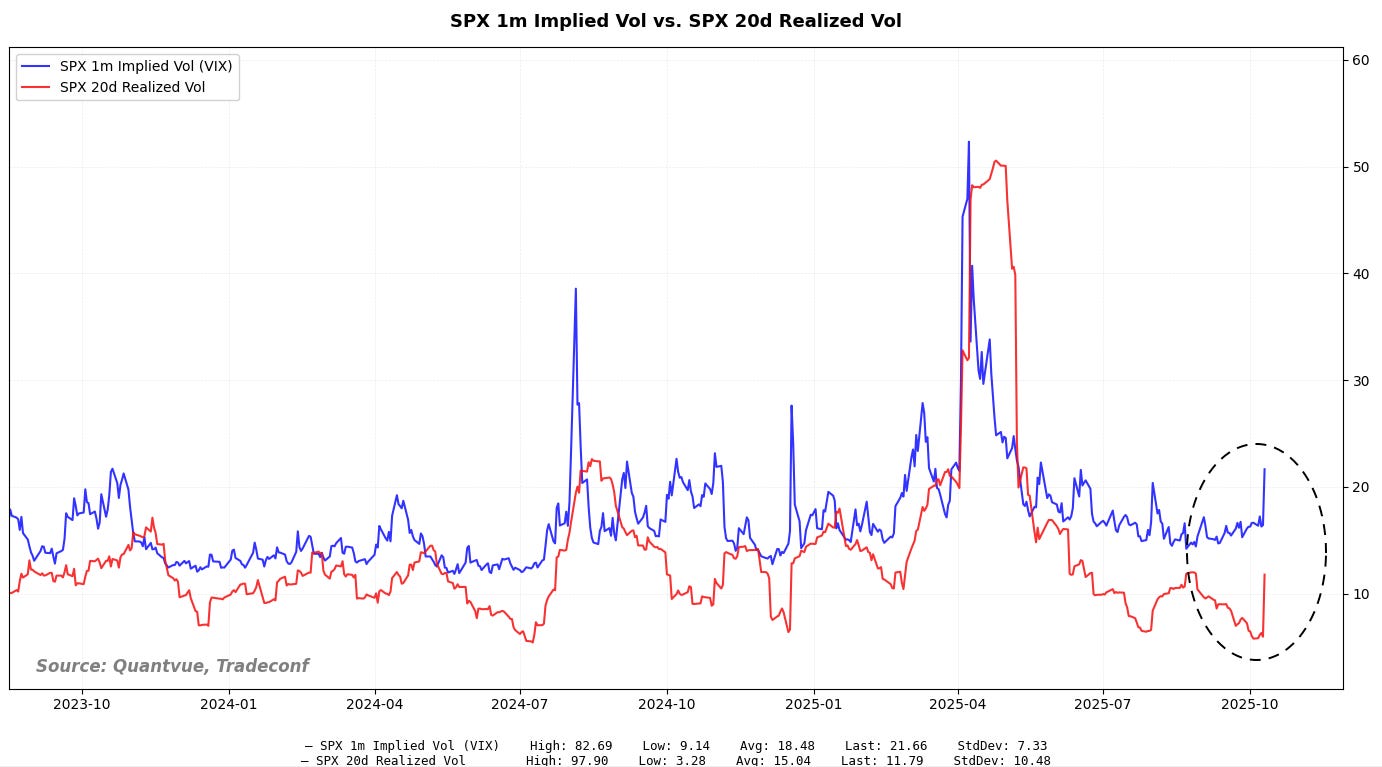

That said, S&P implied volatility isn’t anywhere near where we reached in April or August 2024.

As we said yesterday, we believed that this was a rush to protect large long positions. There is a significant difference between institutional money managers selling blocks of equities and hedging their significant long positions. This has caught a lot of people off guard.

This is a FREE edition of the Market Brief. To receive our institutional-grade intelligence on a daily basis, consider becoming a paid subscriber.