The Market Brief

Futures rallied as optimism grew over reports that the US/China are edging closer to a trade agreement, kicking off a busy week that will also be shaped by the FED and earnings from major tech giants.

Macro Viewpoint

Into the final week of the month, the NDX is up ~3% in October, set for it’s 7th straight monthly gain, matching the longest monthly ‘winning’ streak since 2016-2017.

S&P implied move through Friday (10/31) is 1.76%. Busy week ahead with a heavy dose of Micro (43% of S&P mkt cap reporting), as well as central bank decisions. Watching geopolitical front with Trump/Xi meeting scheduled Thursday.

Prime Intelligence

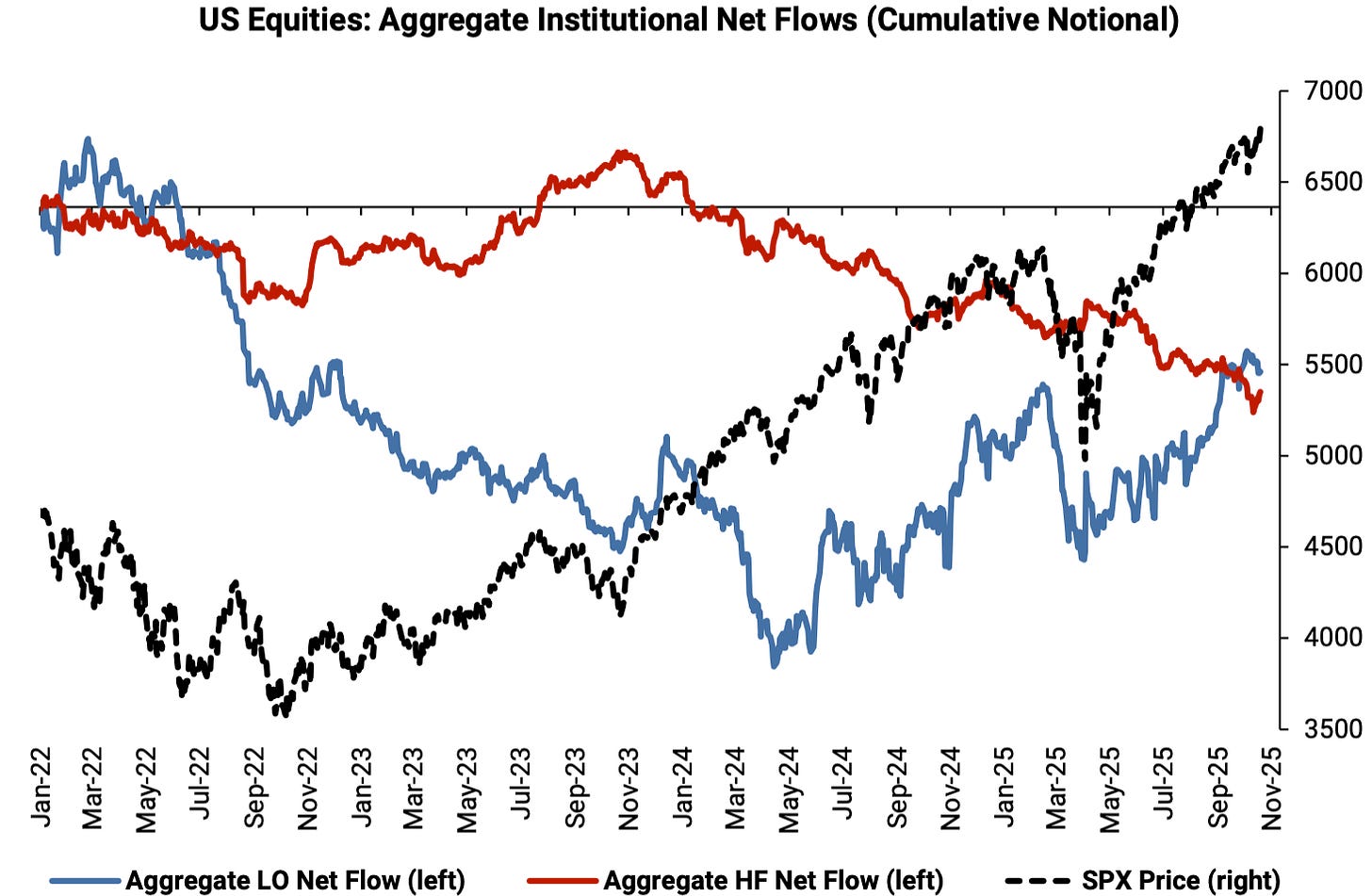

Two weeks ago we observed one of the most aggressive selling periods since liberation day, last week, the hedge fund community started to buy it all back.

After 2 straight weeks of selling, HFs reversed course and net bought US equities last week, driven by short covers in Macro Products and to a lesser extent long buys in Single Stocks. Nearly all of the ETF shorts raised last week (+6.1%) were covered this week.

Over the last two weeks, the stock market has round tripped from extreme fear (VVIX >135) to extreme calm (SPX 3 day realized at 4). Those who were able to distinguish the noise from what the market was actually doing, much like we shared weeks before the fact, saved themselves from a performance disaster.

📰 In today’s Brief, we’re disclosing exclusive updates on institutional flows, what their positioning looks like now, and where they will become sellers.