The Market Brief

US equities edged lower during overnight trading after two days of losses, as traders waited for new catalysts to guide the market’s next move.

Impact Snapshot

🟥 U.S. GDP - 8:30am

🟥 Unemployment Claims - 8:30am

Macro Viewpoint

Second day of modest pullback yesterday despite very low, muted headlines.

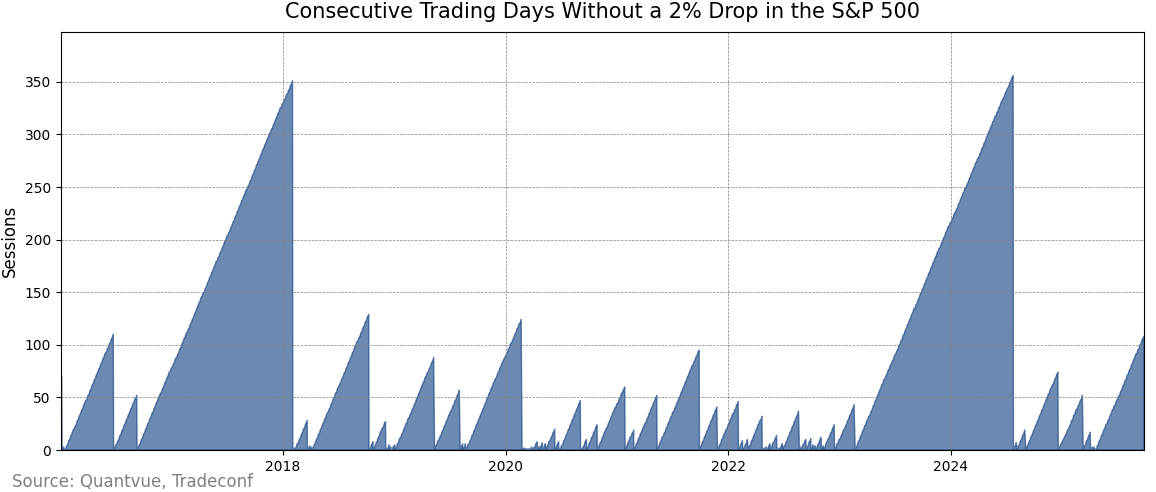

That being said, the S&P 500 has gone 108 sessions without posting a drop of at least 2%, its longest streak since July 2024. So far, no “big” down days.

Much of the conversation has been around potential month-end/quarter-end rebalancing. In our last brief, we’ve noted how this behavior by asset managers rebalancing portfolios can lead to a short-term spike in volatility.

Prime Intelligence

Ever since we’ve spotted this big absorption happening in real time exactly at our first upside level we’ve shared with our subscribers on Monday, the market is now down 78-points from it two days later.

Institutional investors often build significant blocks of limit orders to absorb buying/selling in real time and we can visualise this activity using our Sierra-Suite.

We’ve shared a video replay on how to spot this in real time, check this brief👇

Anything that you’re going to be competitive in and be a professional, the real dividing line between the pros and the non-pros is going to be the nuances. Market nuances such as the above are no different.

Trading is creative problem-solving. The scope of our brief is to help you hone your market-reading skills and understand these type of nuances.