Hey team. A headline, which was later proven to be inaccurate, regarding a possible 90-day tariff extension—the exact one we highlighted during yesterday’s overnight brief—triggered a nearly 8% rally in the SPX within less than 30 minutes yesterday.

In today’s brief, we highlighted all the datapoints we had been seeing beforehand and how one of the most memorable sessions unfolded right after.👇

Macro Viewpoint

Significant debate over whether we’ve reached the point of maximum pain for risk assets. The pricing of recession risk have created an asymmetric risk-reward setup in the short term.

There is a reasonable probability that we see a shift in sentiment, if there’s a wave of deal- making, and a potential easing of tariffs could help reset the current trajectory.

The possible tariffs recession priced is self-inflected and reversible.

Wildest trading session.. EVER

What you saw on the charts yesterday was one of the wildest sessions we have ever seen in modern history, one that rocked institutional desks all over Wall Street.

This was a once-in-a-lifetime type of experience. It will probably be written in some financial books and talked about for decades to come.

If you want to understand and appreciate what happened on Monday, read through this entire article.

Sunday 4/6 - 12:00PM ET

During our Sunday research, we shared our thoughts on where we thought the market would be seeing support heading into the afternoon open in the U.S. This is the exact piece of context we shared with our paid Substack users.

Sunday 4/6 - 18:00PM ET

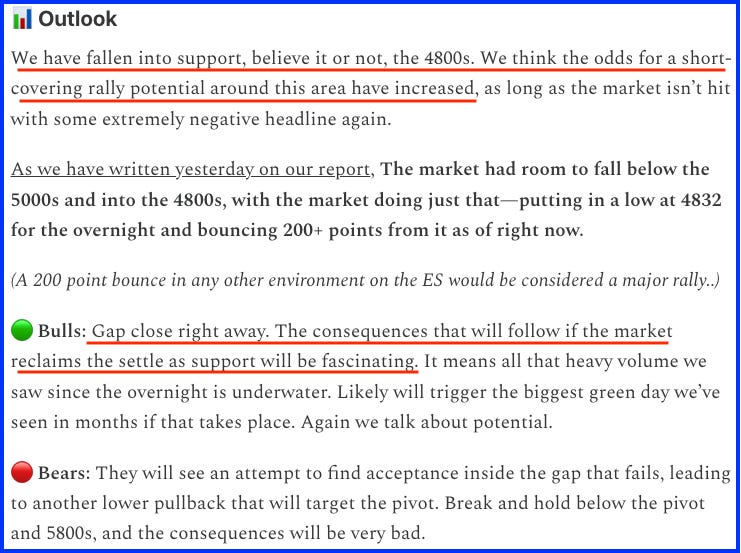

Exactly as we anticipated, overnight opened and the market broke below the 5000s and made its way toward a new low for the overnight at 4832. This was now the absolute bottom of one of the wildest sessions in recent history.

Monday 4/7 - 6:45 AM ET

In our pre-market brief on Monday, we shared the following context on our macro viewpoint, which you can read in the free version of our Substack [here].

Our expectations for the session ahead, based on the combined evidence we saw during the overnight and leading up to this point, were bullish. It didn’t have to do exclusively with the quote we shared above, we couldn’t possibly knew this would come out as a rumour later on—we just had strong evidence of the 4800s being support.

Of course, it’s easy to say it after the fact… right?

Well, guess what—the following context below is the exact market plan we had given at 6:45 AM ET.

Monday 4/7 - 10:00 AM ET

Rumours started to emerge that what we had written as a potential consideration for Trump during our overnight brief was, in fact, “going to happen”.

The market's reaction was exactly as we called for—fascinating and aggressive..

From that overnight low, where we were calling for support at the 4800s, to the peak of Monday’s session, it was ~456 points..

Monday 4/7 - 10:15 AM ET | Wildest 15 min of your career

Reports started to emerge that the White House was “unaware” of Trump considering a 90-day pause.

Market’s reaction? Wiping out 300+ points right away in a single swing..

At 10:15 AM ET, U.S. stocks swung $7 TRILLION in 30 minutes on a "fake" tariff deal headline..

Closing thoughts

We called support and gave a bullish sentiment for Monday’s session, but the follow-up and wild swings that happened couldn’t have been “predicted” by the wildest of imaginations. And we do get some wild imaginations sometimes... believe me.

Waking up and seeing the ES market down 277 points for the overnight, with global markets seeing one-day losses paralleled to the 2008 financial crisis, yet calling for a BULLISH day ahead, takes a certain type of imagination… right?

Have an open mind. Technical analysis is an art, not a science. Be open to the idea and potential of it. If you enter this market with a hard bias, you will constantly look for confirmations of that bias when there aren’t any.

Only then will you start seeing things before any news, world events, economic reports, or candlesticks on the chart could have EVER existed.. like we do.👇